Tax savings is top of mind for every Indian taxpayer whether you’re an employee in Mumbai, a small business owner in Delhi, or a freelancer in Bengaluru. Income tax rates in India can range from 5% up to 30% (plus cess), and that tax bill can take a big chunk out of your hard-earned rupees. But what if legally cutting your tax bill by lakhs was possible? This full-fledged tax savings guide shares 7 simple tax saving hacks to do just that, especially specific to the RupeeNest audience. These tips are simple, practical, and permissible under the Income Tax Act, 1961 and will help you keep more rupees in your pocket.

Table of Contents

Why Tax Saving Matters in India

In India, taxes fund necessary services, but nobody wants to pay more than is necessary. But with the right tax-saving strategies, you can reduce your taxable income, claim deductions, and invest wisely to grow your wealth. There are tax-saving hacks for individuals who are under the old tax regime (with deductions) and the new tax regime (simpler, but with fewer exemptions). Regardless, these tax-saving hacks will help you to save. We are going to show you ways to save ₹50,000 to ₹5,00,000 a year, depending on your income. There are plenty of deductions you can make use of to save you taxes from Section 80C which is most well-known to lesser known deductions.

Let’s dive into the 7 tax saving strategies that can transform your financial planning.

1. Maximize Section 80C Deductions for Tax Saving

Section 80C is the most favored of all the tax-saving vehicles for Indians, as it allows a tax deduction of up to ₹1,50,000 in a financial year. Here are some best practices from my personal experience :

- Invest in ELSS: Equity-Linked Savings Scheme(ELSS) is a tax saving vehicle under Section 80C with a lock-in period of 3 years which is much shorter than other options like PPF (who want to lock in for 15 years?). Assuming you invest ₹1,50,000 in ELSS, you will save ₹46,800 in taxes(income tax bracket of 30%). You can find the top ELSS (if you are risk-averse) funds on Groww or Innate and even do some tax-saving job!

- Paid LIC Premiums: Any premiums paid for life insurances will also get you tax exemptions under 80C. So if you are paying an insurance premiums of ₹50,000 annually you will get ₹15,600 deduction (income tax bracket of 30%). You can compare multiple options and premiums on Policybazaar.

- Contribution to PPF: The Public Provident Fund (PPF) is also a good long term saving vehicle that provides safe and secure tax saving option, with a return greater than 7% p.a. You can contribute a maximum of ₹1,50,000 per financial year.

Pro tip: You can mix ELSS, PPF, and Insurance to take advantage of the full tax exemption of ₹1,50,000. For more on how to budget for claims see our RupeeNest budgeting guide.

2. Leverage Health Insurance for Tax Saving Under Section 80D

Health insurance isn’t just about protection—it’s a powerful tax saving hack. Under Section 80D, you can claim deductions for premiums paid for yourself, your family, and your parents:

- Self, Spouse, and Children: Deduct up to ₹25,000 annually (₹50,000 if you or your spouse is a senior citizen).

- Parents: Deduct another ₹25,000 (₹50,000 for senior citizen parents).

- Preventive Health Check-ups: Claim up to ₹5,000 within the above limits.

For example, a ₹20,000 premium for your family and ₹30,000 for your senior citizen parents can save ₹15,600 in taxes (30% bracket). Use InsuranceDekho to compare plans.

Pro Tip: Opt for multi-year health insurance plans to lock in lower premiums and ensure consistent tax saving. Pair this with our emergency fund tips to stay financially secure.

Also Read: 9 Passive Income Ideas to Multiply Your Earnings

3. Save Taxes with Home Loan Deductions

If you’ve taken a home loan, you’re sitting on a tax saving goldmine. Under the old tax regime, you can claim:

- Section 80C: Up to ₹1,50,000 on principal repayments.

- Section 24(b): Up to ₹2,00,000 on interest payments for a self-occupied property.

- Section 80EEA: An additional ₹1,50,000 on interest for first-time homebuyers (for loans sanctioned between 2019–2022, subject to conditions).

For a ₹50 lakh home loan with ₹3,00,000 annual interest and ₹1,00,000 principal repayment, you could save ₹93,600 in taxes (30% bracket). Check eligibility on the Income Tax India website (do-follow).

Pro Tip: If you’re renting, claim House Rent Allowance (HRA) exemptions.

4. Invest in National Pension System (NPS) for Extra Tax Saving

The National Pension System (NPS) is lesser known tax saving option that can be a great tax saving option, particularly for salaried persons. You can claim tax deduction up to ₹1,50,000 (based on the Section 80C limit) under Section 80CCD(1). And under the Section 80CCD(1B) of the Income Tax Act, an additional deduction of ₹50,000 is allowed, which can be claimed in addition to Section 80CCD(1).

- Example: Investment of ₹50,000 in NPS (Section 80CCD(1B)) will save taxes of ₹15,600 (if you fall under tax bracket of 30%).

- Bonus: Amount contributed by employer to the NPS (up to 10% of the basic salary) are also tax deductible under Section 80CCD(2) and there is no upper limit on the amount.

- Check out: NPS plans on the PFRDA website (do-follow). NPS also creates a retirement corpus, thereby providing a dual purpose tax saving instrument.

- Pro Tip: Consider using NPS investment with other tax saving options, such as ELSS to create a diversified investment portfolio. You can check out our retirement planning tips for more.

5. Claim Charitable Donations for Tax Saving

Charitable donations not only create the “helping people” feeling, but also increase tax saving. Donations made to recognized charities qualify under Section 80G and deductions are available as follows:

- 100% Deduction: Certain funds such as the PM’s national assistance funds qualify for a full deduction and, what’s more, there are no limits on charity funds.

- 50% Deduction: Most registered NGOs, like CRY (Child Rights and You) or Akshaya Patra, are entitled to allow you a 50% deduction to a max of 10 percent of your adjusted gross income.

- For example, if you donate ₹20,000 to an NGO entitled to a 50% deduction, your tax savings would be ₹3,120 (if you were in the 30% tax bracket). Be sure to check which charities qualify at NGO Darpan (follow the link).

- Insider Tip: when you donate, keep the receipts for filing. The tax deductions can be combined with other deductions.

6. Opt for Tax-Saving Fixed Deposits

Five-year tax-saving fixed deposits (FDs) with banks or post offices qualify for Section 80C deductions up to ₹1,50,000. They’re safe, offer 6–7% returns, and are ideal for risk-averse taxpayers. For instance, a ₹1,00,000 FD with a 6.5% interest rate saves ₹31,200 in taxes (30% bracket) while earning ₹6,500 annually.

Compare FD rates on BankBazaar. Major banks like SBI, HDFC, and ICICI offer competitive rates.

Pro Tip: Spread FDs across multiple banks to stay within the ₹5,00,000 DICGC insurance limit.

Check Out: 9 Expert-Approved Ways to Build Wealth on a ₹30K Salary

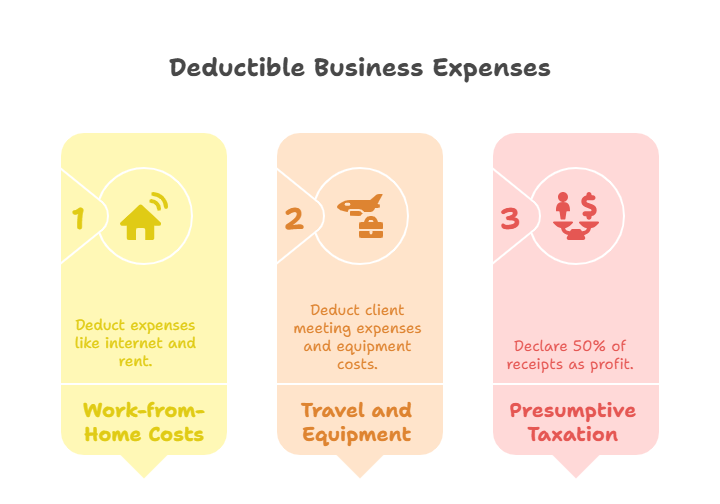

7. Use Business Expenses for Freelancers and Professionals

For freelancers, consultants, and owners of small businesses, claiming business expenses is a game changer when it comes to tax savings. Under the old tax regime, there are various expenses that you can deduct, including:

- Work-from-Home Expenses: You can deduct expenses from work-from-home costs, including the internet, electricity, and you can also deduct a portion of rent. For example, if your rent is ₹5,000/month that works out to ₹60,000/year.

- Travel and Equipment: In some cases, you can deduct the indirect of travel, like meeting with clients or a new laptop (example ₹50,000).

- Presumptive Taxation: As a professional with an income up to ₹75 lakh in income can declare the Presumptive Taxation calculated under Section 44ADA, which allows you to declare 50% of receipts as net profit, therefore reducing your tax payable income.

- For example – a freelancer with ₹10,00,000 receipts and ₹3,00,000 in expenses will be looking to save ₹93,600 in taxes (30% tax bracket). You can find more on the Income Tax e-filing portal (do-follow).

Pro Tip: I like to use bookkeeping and receipts app like QuickBooks to keep a digital paper trail.

Bonus Tax Saving Tips

- Old vs. New Tax Regime: Compare both regimes using the Income Tax Calculator (do-follow). The old regime offers more deductions, ideal for high savers.

- File Early: Submit your ITR by July 31 to avoid penalties and claim all deductions. Use our ITR filing guide.

- Tax-Saving Gifts: Gift money to your spouse or parents to lower your taxable income, but ensure compliance with tax rules.

Conclusion: Start Your Tax Saving Journey Today

These 7 tax saving hacks can reduce your tax bill anywhere from ₹50,000 to ₹5,00,000 a year, or even more with your income and strategy. From Section 80C to claiming business expense deductions, this seven hacks are designed to be both easy to implement and effective for Indian taxpayers. Start from small — invest in an ELSS or NPS, claim your health insurance deductions or get a better structure on your home loan. By doing this consistently, you will see your tax bill getting reduced, and sometimes your savings might as well.

Are you ready to take charge of your financial situation? Read more tax saving tips and personal finance advice on RupeeNest. Share your favorite hack in the comments and help us make every rupee count!