Investing in the stock market can be a fitful experience, especially for those new to investing in stocks in India. With varying stories of massive profits and horror stories of massive losses, it is easy to understand why many first-time investors feel intimidated by the stock market. The Indian stock market, which include indices like Sensex and Nifty can offer great stock price appreciation opportunities—₹1 lakh invested in a good stock can multiply multiple times more value in a span of years; however, although you may be extremely cautious, you can lose all your wealth faster than you can blink, if you make the wrong moves.

In this article, we will explore five risky mistakes to avoid as a novice investor when investing in the stock market, along with some good practical guidance on how to invest wisely. These tips are designed to help you avoid mistakes and return to having a successful experience with stock investments.

Table of Contents

Why the Stock Market Scares Beginners

The stock market is an amazing wealth creation vehicle, but it is not a get-rich-quick scheme. In India, where financial literacy is still developing, beginners to the stock market often jump in with big expectations and little preparations. The mistakes that money novices make that end in costly errors, essentially just losing money and wasting time. Whether you’re investing ₹10,000, or ₹10 lakh, avoiding these mistakes can be what separates success from regret. Here are the 5 mistakes you should avoid, and how to remediate them.

1. Investing Without Research

The #1 mistake beginning stock market investors make is buying stocks from ‘tips’ or hot ‘picks.’ Investing in a friend’s ‘hot stock pick’ or because of a viral post on X about a ‘multibagger’ can seem tempting. But, investing based on tips from a friend or social media post without doing your own due diligence and market research is no better than gambling.

For example, if you buy shares in a company at ₹500 and have no idea how the company actually makes money and the stock price tumbles to ₹200 in panic selling, guess what, you’ve lost a considerable amount of your investment with no clue on how you got there.

How Do You Fix It: Do your research before you buy. There are many platforms and web services like Moneycontrol to help you analyze the company financials; revenue, profits, debts, etc., related to the company you want to invest in. Check out the price to earnings (P/E) ratios to determine whether you are buying an over-valued or under-valued stock; a P/E of above 30 is a red flag, in my opinion. Start with the more established companies (blue-chip stocks) like Reliance Industries or HDFC Bank .

These companies are relatively safer, especially as a beginning investor. Think of reading annual reports of HDFC Bank for 30 minutes or experiencing the excellent you Are Only One Click Away YouTube channels.

2. Trading Instead of Investing

Most newbies also confuse trading for investing. Trading is the practice of buying and selling stocks repeatedly to make money off short-term price swings usually with minimum capital in ₹50,000 – ₹1 lakh and constant following of price action with regards to that stock or ETF. Trading is a high-risk activity—SEBI has noted about 80 – 90% of day traders lose money. For the most part, investing revolves around buying good stocks/funds for the long haul and not watching it on a daily basis. In short, it’s simple and less stress.

How to Fix It: Stick to long-term investing and especially if you are a beginner. For example, if you invested ₹10,000 in a diversified mutual fund over 10 years through Zerodha with an average annual return rate of 12% then you would have about ₹31,000! Day trading is very different as you will likely be doing this every day in terms of actively studying charts and listing potential gains and losses. If you are interested in trading, you can practice trading in a demo account with about ₹5,000 virtual money through some apps and websites like TradingView. Your practice gives you the opportunity to learn without risking any money.

Also Read: Credit Card Traps: 9 Dangerous Habits

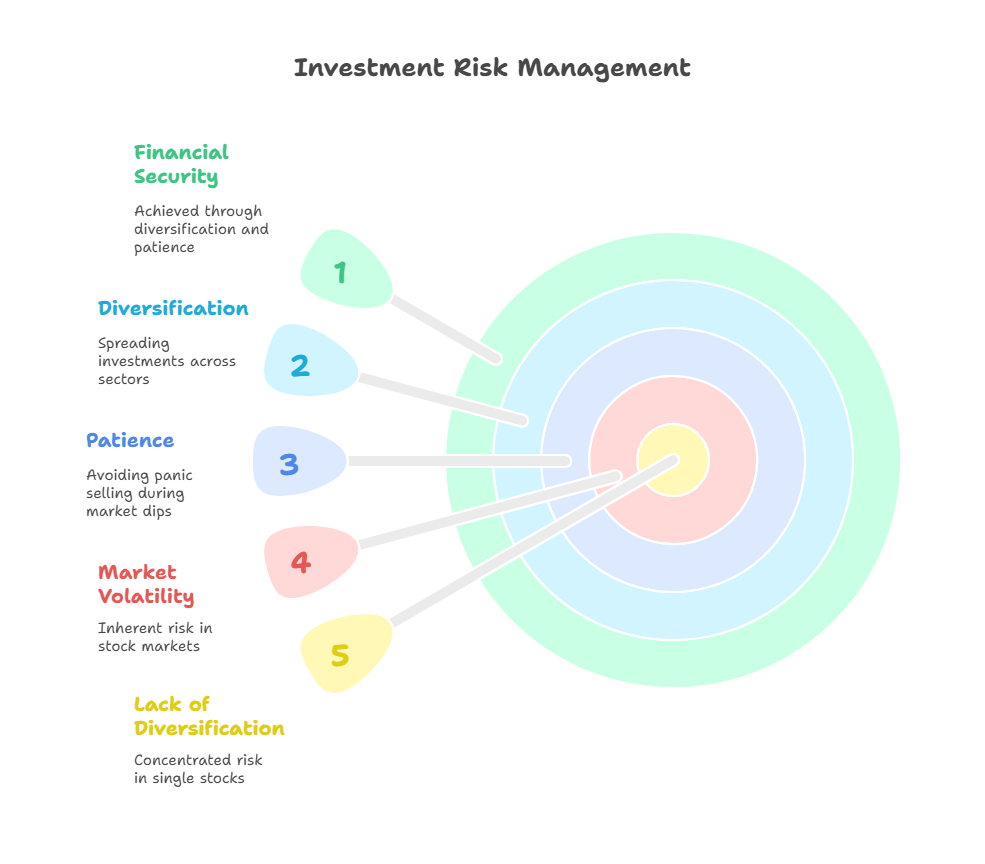

3. Putting All Eggs in One Basket

One of the most typical screw ups when it comes to the stock market is when you don’t diversify. It’s common for a new investor to invest an entire amount of their money — let’s say, ₹2 lakh — into one stock, let’s say a small cap stock that everyone is talking about. If that small cap stock fails, you can lose most or all of your money. I know plenty of investors in 2020 that lost a lot of money for making a large bet on a few single stocks during a volatile market.

How to Fix It: Look to diversify investments in multiple types of sectors, such as IT, banks and consumer goods. For example, put ₹50,000 into a large cap stock such as Infosys, ₹50,000 into a mid-cap stock like Bajaj Finance and put ₹50,000 into an index fund through Groww. You can have instant diversification by investing in mutual funds or ETFs, such as the Nifty 50 ETF for as little as ₹5,000! A smaller investment such as SIP of ₹10,000 a month in a diversified equity fund minimizes your risk as you have the capability of getting your invested amount back while potentially targeting 10–12% returns compounded over time. Diversification shields you from one failed stock.

4. Panic Selling During Market Dips

The volatility of stock markets can be daunting. In my many years as a trainer, when the Sensex or Nifty falls by 5% to 10%, panic starts to set in. In March 2020, the Sensex dropped 10% in a week, and many of my beginner friends sold their stocks at the very low, only to see the market re-coup some months after their sell. Selling in a panic locks in a loss and wipes out an opportunity to gain back on your original investments over the long term.

How to Fix It: Step back, calm down, and think more long-term. If you invested ₹1 lakh in a quality stock like Asian Paints at ₹1,800 and the price drops to ₹1,400, ask yourself whether you would sell now if the company’s fundamentals of profitability, market share etc. were still intact. Significant dips in the stock price are generally commonplace, especially during periods of volatility in the market.

If this happened in an overall period of adjustments to heard mentality across an entire market, then make sure you try your best to buy up some more shares at a lower price point, the strategy is referred to as “averaging down”. Other times and in other regions of the world, significant price movements in shares may cause short-term panic in investors who may mistakenly act upon short-term price movements instead of longer-term positive indicators like successful products or innovative moves by senior management.

There are great tools to help you track share price trends on ticker symbols within months timelines that generate interest too – I encourage you to check out the tools on ET Money – emotions only muddy an important financial decision that should be take with as clear decisions as possible! Just suppose you invested another ₹20,000 while the shares in the market were re-adjusting price fundamentals, hypothetically, the next time the overall market recovers again, the value of your additional investment value might also lead to further gains on your original investment.

Check Out: Emergency Fund Mistakes: 7 Costly Errors

5. Borrowing to Invest in Stocks

Investing in the stock market by way of borrowing money is like playing with fire in that you’re playing in an area that is uncertain and if you miscalculate, you could potentially lose everything. Beginners, as mentioned before, are known to take personal loans at 12–15% interest, or use credit cards, to invest ₹5 lakh in order to “double their money.” If the market drops overnight they lose their money (which was never theirs in the first place), and they still owe the loan, plus interest. To illustrate, if you take out a ₹5 lakh loan at 15% interest, you will owe ₹75,000 in interest alone on a yearly basis.

How to Fix It: First and foremost, ONLY invest money that you can afford to lose. For example, you could initiate your investment journey using ₹5,000 by Base Capital Monthly SIP with a mutual fund instead of investing money that is on loan by using margin trading. A budgeting app such as Walnut can help keep track of your spending habits and provide you ideas for improving your finances by finding areas to save.

For example, if you manage to save ₹3,000 each month over a 12-month period you will have earned ₹36,000 to invest without debt. Second, if you are tempted to borrow or use credit to invest, then have an honest conversation with yourself on whether or not you are ready to accept the reality that the stock market allows for high levels of uncertainty, and that debt takes this uncertainty and amplifies it significantly.

Bonus Tips for Stock Market Success

While avoiding these mistakes is a great starting point, here are five extra tips to succeed in the stock market:

- Buy Mutual Funds: If picking individual stocks seems overwhelming, just buy mutual funds to begin. A ₹5,000 SIP each month in a large cap fund through any SBI Mutual Fund is less risky and requires less research/output.

- Never Stop Learning: Financial literacy is crucial. Take advantage of resources that are free, including Investopedia or Zerodha’s Varsity to help you understand the terms, descriptive things like dividends, EPS, market cap.

- Have Realistic Goals: Remember, the stock market is not a lottery. Your goal should be to get an average annual return of 10-12%, not 50% overnight. For example, ₹1 lakh invested at an annual return of 12% would grow to ₹3.1 lakh in 10 years.

- Open a Low-Cost Demat Account: High brokerage costs can take away your return. You may want to open a demat account with brokers that provide services like Upstox for annual fees of ₹1,000 instead of ₹5,000.

- Check Your Investments: It is a good idea to check your investments on a quarterly basis to ensure you are still on track to achieve your goals. Apps like Moneycontrol will help you find real-time updates and help you to easily remain informed.

Real-Life Example: From Mistakes to Mastery

Let us meet Priya, a 30-year-old teacher in Pune, India, who started putting ₹50,000 into the stock market in 2021. She was thrilled when a friend’s stock pick led her to put all ₹50,000 into a small-cap stock without doing her own research. Priya then panicked when her below-pick began falling, and she sold, and lost ₹12,500. Priya was motivated to learn and…

- She did her research on companies using Moneycontrol.

- She diversified her next ₹50,000 into a Nifty 50 ETF, blue-chip stock HDFC Bank, and mutual fund through Groww.

- Held firm during a market dip in 2022 without panic selling.

- Established a ₹3,000 monthly SIP to grow her portfolio to approx ₹7 lakh in 10 years based on 12% returns.

Today, Priya’s portfolio is worth ₹80,000 and growing. Her story illustrates that when you give yourself the opportunity to learn from mistakes regarding the stock market, you become more confident in your abilities, and ultimately will succeed!

Conclusion: Conquer Your Stock Market Fears

The stock market doesn’t need to be frightening. You can take action to save your money and grow your wealth if you avoid these five mistakes – don’t invest without research, don’t trade impulsively, don’t forget to diversify, don’t panic sell, don’t borrow. Start small, be patient, and keep learning. Today, investing in India’s stock market has never been easier with Zerodha and Groww. Whether it is ₹2,000 or ₹2 lakh, it is time you took that first step and start to grow the wealth that belongs to you.

Which stock market mistake you made, or which tip will you take action on first? Let us know in the comments and find more investment tips on our website!

“The stock market is a wealth-building tool, not a casino—invest with knowledge, not fear.”