For many Indians, savings accounts are at the center of their financial lives. From salaried employees in Delhi to shopkeepers in Ahmedabad, savings accounts are safe, accessible, and can be excellent places to store both emergency funds and day-to-day spending. On the other hand, savings accounts in India typically pay 3-4% interest. This isn’t much higher than inflation (6-7%) in India. Where can you find a better return on your savings without taking on risk?

In this article, you will discover 7 tricks to increase the interest you earn by using your savings to maximize the gains on your money. While these tips are specific to banking in India, they are useful, simple and actionable ideas specifically designed for RupeeNest’s readers that want to build wealth.

Table of Contents

Why Maximizing Interest Matters

With the rupee inflating in India, earning more from your savings can add thousands to your assets each year. Inflation is decreasing the purchasing power of your currency and if you have a account paying poor interest you could be losing ₹3,000 – 5,000 a year in real value from a balance of ₹1,00,000. By following these secrets of savings accounts you can earn interest upwards of 7% or even better, which will convert your idle cash into a wealth machine. Let’s explore 7 tricks to ramp up the returns from your savings !

1. Choose High-Interest Savings Accounts

Myth: The interest rate on savings accounts is the same everywhere.

Truth: There are many types of accounts and not all are created equally. A large bank, such as SBI or HDFC Bank may offer a 3 or 3.5% interest rate. Compare this with a small finance bank or digital bank, which often provide rates in the 6-7.5% range. For example, on a ₹5,00,000 balance, the interest at 7% is ₹35,000, versus ₹15,000 at a 3% interest offer.

- Small finance banks, such as Equitas Small Finance Bank, Ujjvan Small Finance Bank or AU Small Finance Bank now offer high-interest with rates up to 7.5% on savings accounts over ₹1,00,000 or more.

- You can compare interest rates using BankBazaar. Get savers account with the highest rate possible.

Actionable: Open a high-interest account with a small finance bank offering 6%+ interest. Ensure that your savings account is covered by DICGC insurance for up to ₹5,00,000.

2. Maintain a Higher Average Balance

Many savings accounts offer interest rates in tiers based on your average quarterly balance (AQB). For example, Kotak Mahindra’s ActivMoney savings account offers 7% interest on any balances above ₹25,000, with the condition you have auto-sweep into fixed deposits. Similarly, IDFC First Bank offers 6.5% interest on balances above ₹1,00,000.

So, for a balance of ₹2,00,000, a 7% account earns ₹14,000/year, compared to ₹6,000 in a 3% savings account. Confirm your eligibility and the terms on IDFC First Bank. You can combine this with our budgeting guide to help maintain higher balances.

Action: Always move your funds from many low-interest savings accounts into one high-yield savings account which gives you a higher interest rate after hitting a minimum balance number.

3. Use Auto-Sweep Accounts

Auto-sweep accounts create opportunities to earn excess interest. They automatically sweep funds above a pre-decided limit like Rs.25,000 – into a fixed deposit account that earns higher fixed rates (6-7%) whilst preserving the liquidity of your savings account. For example, SBI’s Savings Plus Account, is a bank savings account that sweeps funds into fixed deposits at 6.5% at a yearly income of Rs. 13,000 per year based on an average balance of Rs. 2,00,000 compared to Rs.6,000 for a standard savings account.

Action: Get comfortable and activate the auto-sweep feature on your account to earn some returns as if fixed deposits were a requirement without the long-term lock-in.

Also Read: 10 Smart Ways to Save Money Without Feeling Deprived

4. Leverage Digital-Only Savings Accounts

Digital banks, such as Niyo or Jupiter, offer accounts with zero minimum requirements and interest rates of up to 6-7%. In addition to the benefits of instant transfers and no maintenance fees, the accounts offer higher interest on lower balances. For instance, a ₹50000 balance in a Jupiter savings account with 6% interest rate generates ₹3000/year as opposed to ₹1500 with 3% from a traditional bank for the same balance.

Action: Open a digital account with a neo-bank for a higher interest rate and lower maintenance fees. This option is suitable for young professionals and freelancers.

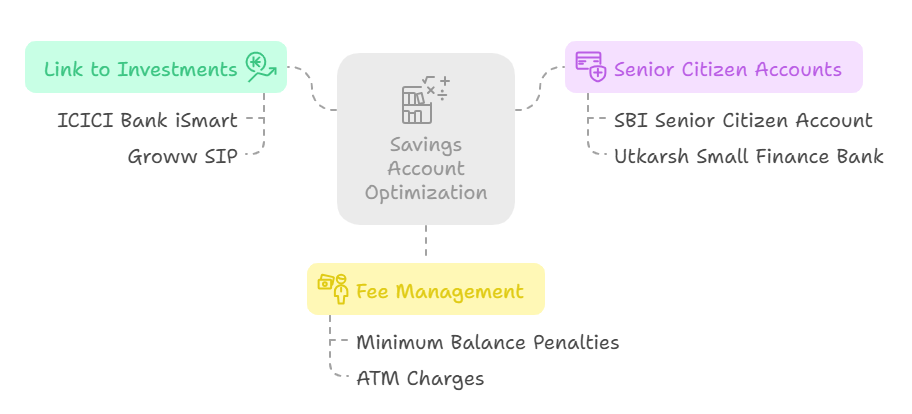

5. Link Your Account to Investments

Certain savings accounts will offer additional interest if they are linked to investments such as mutual funds and recurring deposits. For example, ICICI Bank’s iSmart savings account will offer 5–6% interest if you have a recurring deposit or SIP with them. Thus, if you have a balance of ₹1,00,000 and earn 6% interest, you will earn ₹6,000/year, and you will also be able to build your investment corpus.

Open a SIP through Groww and link it to your savings account. Take a look at our investment basics article for additional information on mutual funds.

Action: Open and maintain a ₹5,000/month SIP or recurring deposit linked to your account in order to maximize interest rates.

Check Out: 9 Expert-Approved Ways to Build Wealth on a ₹30K Salary

6. Take Advantage of Senior Citizen Accounts

If you’re a senior citizen (60+), accounts designed for you offer 0.5–1% higher interest. For example, SBI’s Senior Citizen Account pays 4% versus 3% for regular accounts, and small finance banks like Utkarsh offer up to 8% for seniors. On a ₹5,00,000 balance, 8% earns ₹40,000/year versus ₹15,000 at 3%.

Even if you’re not a senior, open a account for your parents to maximize family savings.

Action: Open a senior citizen account for eligible family members to earn extra interest.

7. Monitor and Negotiate Bank Fees

Fees hidden in savings – like minimum balance exacted penalties (₹500-2,000/quarter), or ATM fees (₹20-50/transaction) – reduce the amount of interest you earn each quarter. Many banks will waive fees based on a higher balance, or the member may negotiate with a relationship manager. For example, avoiding a ₹1000 penalty quarterly on a ₹50,000 savings account is equivalent to earning an additional ₹4,000 yearly.

Review the fee structures online at the Reserve Bank of India’s website. Cost cutting strategies can improve your earnings.

Action: Review your statement for fees and look for a zero-balance account or negotiate fees in advance.

Bonus Account Tips

- Compare Regularly: Interest rates change, so review account options annually. Use ET Money (do-follow) for real-time comparisons.

- Automate Savings: Set up auto-transfers to your account on payday to maintain high balances and earn more interest. See our budgeting guide.

- Diversify Savings: Keep emergency funds in a high-interest account and invest excess in mutual funds for better returns. Check our tax saving guide.

Conclusion: Unlock Your Account’s Full Potential

A account is more than just a place to park money; it’s a way to build wealth! It’s possible to increase the amount of interest you earn from a savings account from 3% to 7% or higher; by using one or more of these 7 account secrets, adding ₹5,000-50,000 to your wealth net each year. This can be done by switching to a high-yield savings account, using the auto-sweep feature, or just avoiding pesky fees that are charged to your account. The little things add up!

You can start right away, and make sure money is working hard for you!

Do you want to take advantage of your savings? Read more savings account tips and advice at RupeeNest, and comment below your favorite secret to earn money working for you!

“Small changes in your savings account can lead to big wealth. Make your money work as hard as you do!”