Retirement planning is crucial for building a secure future, and passive income plays a pivotal role in ensuring financial stability during your golden years. In India, where rising living costs and longer lifespans are reshaping retirement needs, relying on passive income streams can make or break your plans. However, many people make critical mistakes that jeopardize their retirement dreams. This article uncovers eight shocking retirement planning mistakes that can ruin your future and offers practical tips to avoid them. By steering clear of these pitfalls and focusing on passive income, you can retire comfortably and confidently.

Table of Contents

Why Passive Income Is Key to Retirement Planning

The foundation of a strong retirement plan is passive income, which includes profits from sources like dividends, rent, or internet endeavours that require little continuous work. Passive income guarantees that your savings last in India, where traditional pensions are uncommon and inflation averages between 5% and 7% per year. Planning errors can undermine these sources of income, making you vulnerable financially. Let’s examine the eight mistakes to steer clear of.

1. Ignoring Passive Income Opportunities Early On

Few retirement planning activities rank as highly detrimental as delayed creation of passive income streams. Investing at a later age in stocks or real estate, say in the 50s, will surely cost you untold wealth from missed decades of compounding. For instance, if you invest ₹1,00,000 at age 30 in a mutual fund with a 12% return per annum, your value could swell up to ₹29,60,000 by the time you are 60. Starting at 50 would fetch you only ₹3,86,000.

How To Avoid This Mistake:

- Begin with small investments like mutual funds with Moneycontrol.

- Opt for low-maintenance ideas like fixed deposits (₹10,000 minimum).

- Learn more in our early investment guide.

2. Relying Solely on Active Income

Most Indians rely on their salaries or their business income into retirement, assuming it will last through retirement year. The issue is that active income stops in retirement, and if you have no true passive income to take over such as dividends or rent; this could be financially devastating, as the danger becomes exhausting your savings in retirement. For example, for a 30 year retirement living expense of ₹50,000/ month in retirement assumes retirement corpus of ₹1.5 Cr. at a 4% withdrawal rate.

How to Avoid this Mistake:

- Build multiple sources of passive income, like from stock or rental income.

- Start small; even ₹5,000 per month SIP.

- Please check our passive income strategies for examples.

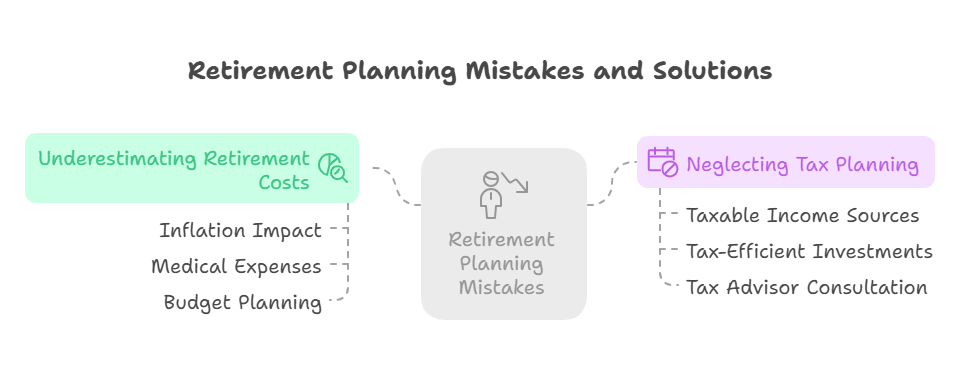

3. Underestimating Retirement Costs

Underestimating expenses is a shocking blunder and can wipe out your passive income. Inflation in India is pushing prices higher at a higher rate than most expenses you will encounter in life. For example, ₹50,000 a month today could end up costing you ₹1,35,000 a month in 20 years at 5% inflation. Medical expenses are also usually high, and it is common for seniors to pay ₹5,00,000—₹10,00,000 a year, which most fold don’t consider.

How to Avoid This Mistake:

- Use BankBazaar’s (dofollow) inflation calculators to estimate your future costs.

- For medical care, either have comprehensive medical insurance or set aside ₹10,00,000 for emergencies.

- Use our budget planning worksheet to project your expenses.

4. Neglecting Tax Planning for Passive Income

Types of passive income such as dividends, interest or rents are all taxable in India; underestimating taxes will destroy your retirement plan. For instance, rental income on a property of ₹20,000 per month will be taxed in your income slab (which range from 0%-30%); the resultant net income from this source may be insignificant.

How to Correct This Mistake:

- Invest in tax-efficient sources like ELSS mutual funds (with a ceiling of ₹1,50,000 annually, subject to section 80C).

- Ask your tax advisor to help you prevent taxation on passive income and this will help in your retirement plan.

5. Over-Investing in a Single Passive Income Source

Investing all your savings in one stream of passive income (like real estate, ie. ₹50,00,000 for a property) is not a good idea because if there is market crashor you experience tenant issues or there is simply a low return on it and it can spoil your retirement. In fact, for example, if you have a property yielding ₹20,000 per month in rent, while rents are not rising and costs are going up, your maintenance fees can easily consume all or most of your rent.

How to avoid this mistake:

- Diversify your portfolio between stocks, fixed deposits, digital products.

- Invest ₹2,00,000 – ₹5,00,000 across assets.

6. Ignoring Passive Income from Digital Ventures

Many people dismiss digital endeavors such as blogs, YouTube channels, or eBooks as realistic sources of passive income. If you have a blog that earns ₹10,000 a month from ads or affiliates that is a potential income contribution of ₹1,20,000 to your retirement portfolio. There is no shortage of internet saturation, and digital income is easily attainable in India.

How to Avoid this Mistake:

- Set up a blog or YouTube channel that will cost you next to nothing (₹2,000 – ₹5,000).

- Monetize the blog/channel via Google ads or affiliates.

Also Check Out: Credit Card Traps: 9 Habits That Kill Your Credit Score

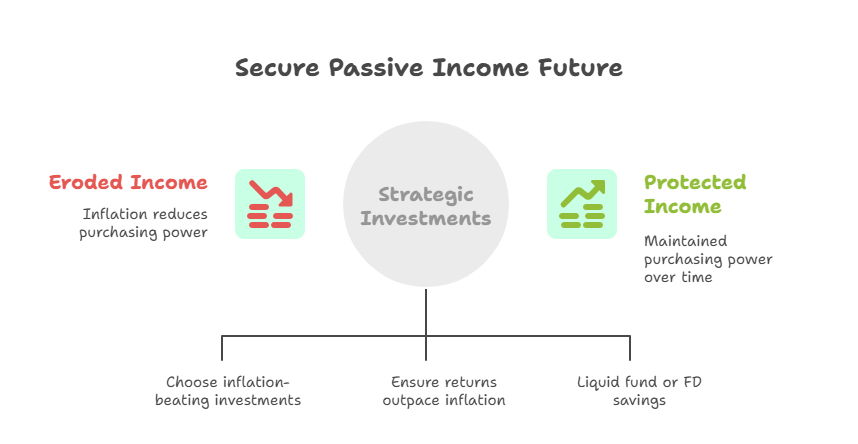

7. Not Accounting for Inflation’s Impact on Passive Income

Inflation erodes the purchasing power of your passive income. A ₹50,000 monthly income today may only be worth ₹18,500 in 20 years at 5% inflation. Failing to choose inflation-beating investments, like equity mutual funds (10–12% returns), can leave you short.

How to Avoid This Mistake:

- Invest in equities or mutual funds for higher returns.

- Review your portfolio yearly to ensure it outpaces inflation.

8. Failing to Create an Emergency Fund

A serious emergency can take unexpected expenses, such as medical costs (₹1,00,000–₹5,00,000), and you may be forced to sell margin assets and liquidate passive income assets and sell stocks or property at a loss. This could breach your retirement plans and could reduce your future income.

How to Avoid This Mistake:

- Save ₹5,00,000–₹10,00,000 in a liquid fund or FD.

- Use high-interest savings accounts for access.

Tips to Build Passive Income for Retirement in India

To secure your retirement plan with passive income:

- Start Early: Even ₹5,000 monthly investments can grow significantly.

- Diversify: Combine stocks, real estate, and digital ventures.

- Monitor Regularly: Review passive income streams yearly.

- Plan for Taxes: Use tax-saving tools to maximize returns.

- Stay Informed: Follow platforms like Moneycontrol for market updates.

Read out: Quick Hacks to Save More Money

Conclusion

Retirement planning in India is based on creating sustainable streams of passive income but the following eight mistakes can ruin your future: delaying your investments, being completely dependent on earning through active income, underestimating your expenses and aspirations, neglecting to plan for taxes, over-investing in one single asset class, ignoring the potential of digital businesses, overlooking inflation, and missing out on building an emergency fund.

If you want sustainable sources of passive income such as: dividends (₹3,000–₹10,000 for every ₹1,00,000 invested) or rentals (₹20,000 per month) you need to begin investing now and focus both on diversification and inflation.

Take the first step with our retirement planning guide, check your portfolio on BankBazaar and secure your retirement plan in your golden years through sustainable, consistent, passive income streams!

2 thoughts on “Retirement Planning: 8 Shocking Mistakes That Can Destroy Your Future”