Passive income is the dream of creating income with little continual effort required, allowing you to financially earn while sleeping, traveling the world or trying to do what you love. In India, where financial independence is becoming an elusive ideal, Passive income streams could help you confidently gain financial security and freedom. No matter if you are a salaried employee, student, or entrepreneur, if you can develop some passive income streams, they could help you take control of your financial future.

This article outlines six amazing ways to create passive income in India suitable for different budgets and skill levels. If you can avoid some of the common failings and take advantage of these techniques, you can generate wealth with ease.

Table of Contents

What Is Passive Income and Why Does It Matter?

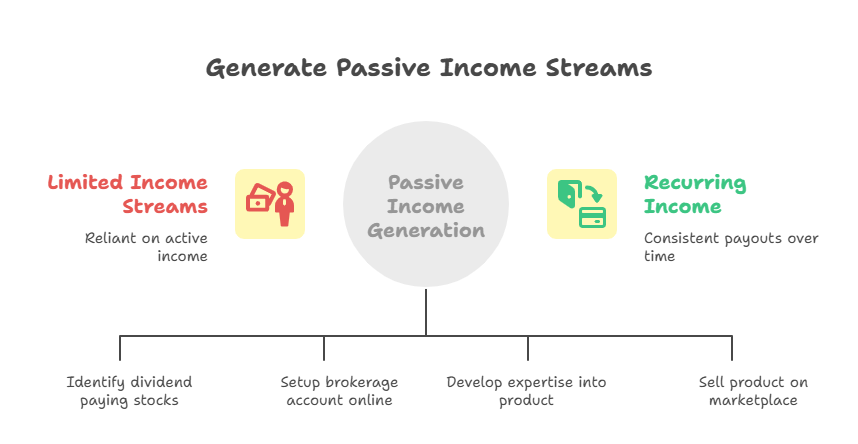

Passive income is income that you generate which requires little or no daily effort after you’ve set it up. Passive income is very different from active income (like your job income) because it doesn’t take consistent work to sustain it. Passive income streams include accepting rent on an apartment, earning dividends, or getting paid for online content you’ve created.

For people in India, passive income can help alleviate the concerns in the market today related to the ongoing cost of living crisis and job insecurity – so it can provide protection and even the ability to leave work and do your own thing if you build your income streams wisely and you are financially capable of doing so. Now let’s explore six actionable ways to generate your own passive income streams.

1. Invest in Dividend-Paying Stocks

When it comes to passive income in India, investing in dividend-paying stocks is an often-used strategy. Companies like Reliance Industries or TCS pay dividends to their stockholders, providing periodic payments. For example, if you were to invest ₹1,00,000 in a company issuing dividends of 3% annually, it would yield ₹3,000 per year (payable quarterly or yearly), and you would not have to do anything, besides making the investment.

How to get started:

- Research large and stable companies with a history of paying dividends using websites like Moneycontrol.

- If needed, open up a demat account with a broker, such as Zerodha or Upstox (setup costs around ₹200–₹500, the actual purchases will have different costs).

- Start small, reinvest dividends and diversify your holdings to reduce risk.

2. Create and Sell Digital Products

Digital Goods like eBooks, online courses, or templates are a great way to create passive income. Once created, it can be sold multiple times without any additional effort. For example, if you sold a eBook about financial planning for ₹999 one hundred times, you would earn ₹99,900.Websites like or Instamojo allow anyone to sell to other countries or in India.

How to Start:

- What is educated on (i.e., cooking, coding, or fitness).

- Create a product using things like Canva (for free) or Google Docs.

- List it for sale on Gumroad or your website for repeat sales.

Also Read: Most Indians Fail at Financial Planning and How to Fix It

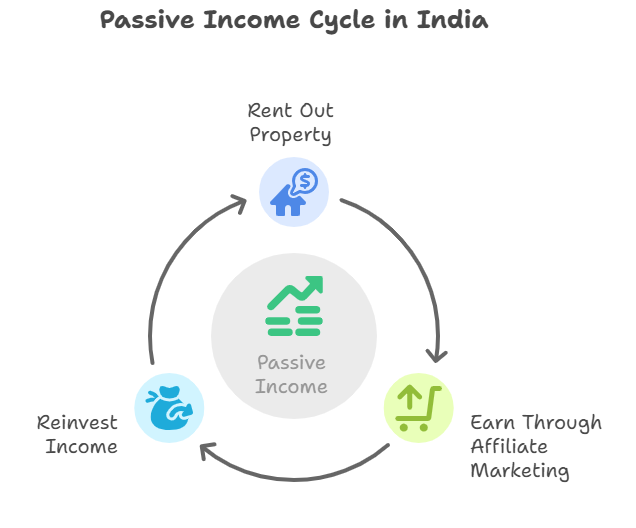

3. Rent Out Property or Space

Real estate remains a solid passive income source in India. Renting out a property, or even a room, can generate steady cash flow. For example, renting a 2BHK apartment in a metro city like Bangalore for ₹20,000 monthly yields ₹2,40,000 annually. If owning property is out of reach (₹50,00,000+ for a flat), consider renting out parking spaces or storage areas for ₹2,000–₹5,000 monthly.

How to Get Started:

- List your property on Housing.com (dofollow) or local brokers.

- Ensure legal agreements to avoid tenant issues.

- Start with small spaces if you’re not ready for big investments.

4. Earn Through Affiliate Marketing

Affiliate marketing allows for you to promote products online and receive a commission as a reward. There are many affiliate programs commonly used in India that pay each time a sale is made. For example, many affiliates use companies like Amazon Associates or flipkart affiliate to make on average between 1%-12% in sales. Therefore, if you share an item worth ₹10,000 and the product offers 5% commission, you will earn ₹500 for each sale. Any blog, YouTube channel, or social media user can benefit from affiliate marketing if you are willing to share affiliate links.

It is as simple as :

- Start a blog or YouTube channel on your niche (like tech, or fashion)

- Join one or several affiliate programs (like Amazon Associates: dofollow)

- Create content that will help promote the product/service with the affiliate links and put them in your social media accounts.

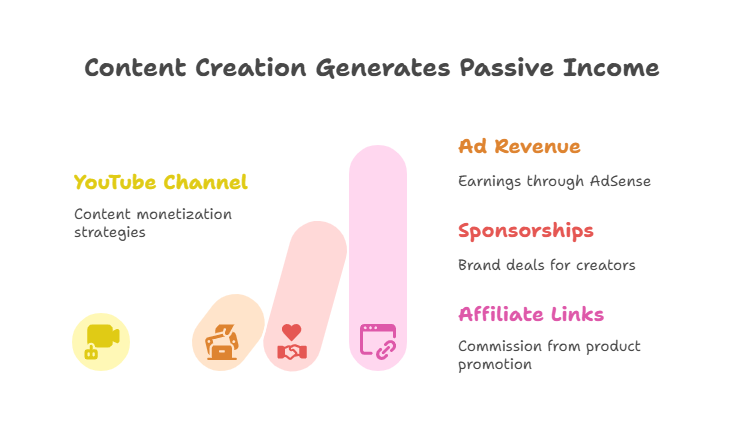

5. Build a YouTube Channel or Blog

When generating content on YouTube or a blog, passive income can be made through the ads, sponsorships, or affiliate links that you place. For instance, if you had a YouTube channel that got 10,000 views for every video and earned around ₹100–₹200 for every 1,000 views (through Google AdSense), that is a gain of ₹1,000–₹2,000 in passive income for just producing 1 video. Likewise, some blogs can operate through ads or affiliates to gain passive income.

How to Get Started:

- Choose your niche (e.g. personal finance, travel).

- Use free resources like WordPress for blogs or basic video software to produce videos.”

- You can monetize with AdSense or affiliates after building an audience.

6. Invest in Fixed Deposits or Recurring Deposits

Fixed Deposits (FDs) and Recurring Deposits (RDs) are low-risk passive income vehicles in India. Banks are offering 6-7% annually on FDs (for example, a FD of ₹5,00,000 at 6.5% pays ₹32,500 a year). With RDs, you can save smaller amounts every month (e.g. ₹5,000) and earn interest as you go.

How to get started:

- Compare FD interest rates using BankBazaar.

- Choose your tenures (anywhere from 1-5 years) based on your preferences.

- To have a regular income, take the interest personally (monthly or quarterly).

Check Out: 7 Proven Ways to Save More Every Month

Common Mistakes to Avoid with Passive Income

While these strategies can generate passive income, avoid these pitfalls:

- Expecting Quick Results: Most methods require upfront effort or investment. For example, a blog may take 6–12 months to monetize.

- Ignoring Taxes: Passive income like rent or dividends is taxable in India. Consult a tax expert or read our tax planning guide.

- Lack of Diversification: Don’t rely on one income stream. Combine stocks, digital products, and FDs for stability.

Tips to Maximize Passive Income in India

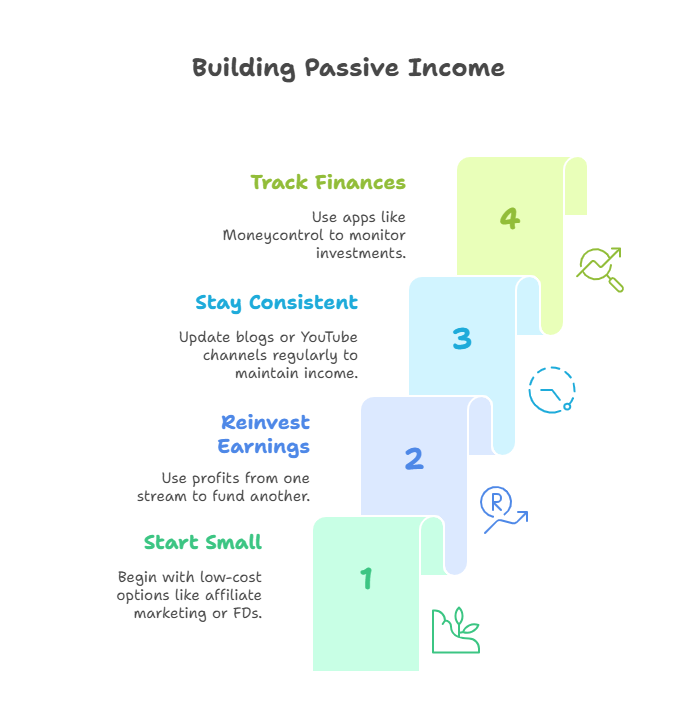

To optimize your passive income journey:

- Start Small: Try low-cost choices like affiliate marketing (₹0 – ₹1,000) or FDs (₹10,000+).

- Reinvest Earnings: Use earnings from one income stream (like dividends) earned to create or fund another (like digital products).

- Stay Consistent: With blogs or Youtube channels you need to be consistent to keep that income coming in.

- Keep Track of Finances: Use apps like Moneycontrol to keep track of investments.

Conclusion

Passive income can be a breakthrough for you to attain financial freedom in India! Passive income is money you make whether you are sleeping, traveling or pursuing one of your passions. You can earn passive income from dividend stocks (₹3,000–₹10,000 annually on average per ₹1,00,000 invested), digital (online) products (₹999 for each sale), or rental income that can range from any amount you offer to ₹20,000/month. These six passive income streams can all be put to good use at different costs and levels of effort.

The purpose of this article is to illustrate some methods of passive income which can continue to generate revenue for you for years and decades to come with much less effort required after start-up. You do not have to jump into everything at once, pick one or two, such as Affiliates or FDs, try them out, and as you gain experience and confidence enlarge and maximize your revenue. Avoid the common pitfalls, reinvest your earnings, check Broker and BankBazaar for resources, tools and support to make you successful. Take the time today to get started on passive income and watch your money work for you! Plan your financial future using our financial planning tool!

1 thought on “Passive Income Joy: 6 Amazing Ways to Earn While You Sleep”