Introduction to Mutual Funds in 2025

Mutual Funds are one of the easiest and best ways to create wealth in India. Whether you are a new or experienced investor, Mutual Funds provide an opportunity to diversify your investments, manage risk and meet your long-term financial goals. In 2025, Mutual Funds still provide an excellent opportunity for the millions of Indians who benefit from India’s growing economic environment and rapidly extending investments. In this article, you will learn 5 proven methods to get the maximum benefit from your Mutual Fund investments.

You will learn how to get the most out of your investments, from liquidating your funds to using Systematic Investment Plans (SIPs). Let’s see how you can have Mutual Fund success in 2025!

Table of Contents

Why Mutual Funds Are a Smart Choice in India

Mutual Funds are investment vehicles that gather money from a number of investors so that the fund can invest in a diversified selection of assets such as stocks, bonds, etc. Mutual Funds consist of professional fund managers to manage the investments. The popularity of Funds in India can be attributed to its low costs (you can get started with just ₹500), flexibility, and potential for higher than average returns. With Sensex and Nifty hitting all-time highs in 2025, Mutual Funds are an easy way to participate in this growth without the obstacles of individual stock pickers!

To learn more about, read this guide from the Association of Mutual Funds in India (AMFI).

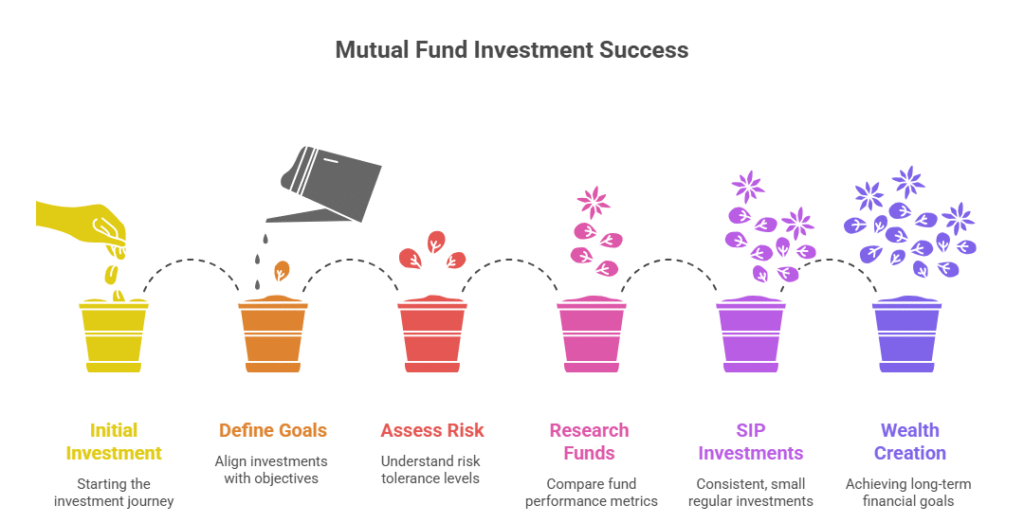

1. Choose the Right Mutual Funds for Your Goals

Align Your Investments with Your Objectives

The first step in success is investing in funds that suit your goals, tolerances and time horizon. Different funds have different risk and reward profiles: Equity, Debt, Hybrid, and Sectoral. Equity Mutual Funds are suitable for long term wealth creation, while Debt funds may suit a conservative investor that is looking for stability.

How to choose:

- Establish Your Goals: Are you saving for a house (5-10 years) or for retirement (20+ years)? For long term goals, equity Mutual Funds have been shown to have annualized returns of 10-15%.

- Assess Your Appetites for Risk: If you are a young investor, you may be able to invest in small-cap or mid-cap funds. A retiree maybe better off in large-cap or some debt funds.

- Conduct Research on the Mutual Funds: Look at Moneycontrol or Value Research to analyse past performance, compare expense ratios (look for <1%), and study the fund manager’s previous performance.

- Example: A Systematic Investment Plan (SIP) of ₹5000 a month, invested for 20 years in a large-cap fund like HDFC Top 100, would grow to ₹23,00,000 at 12% return.

Pro Tip: It is usually good to spread risk across 3-5 Funds. For example, you can invest your money in 50% equity, 30% hybrid, and 20% debt fund.

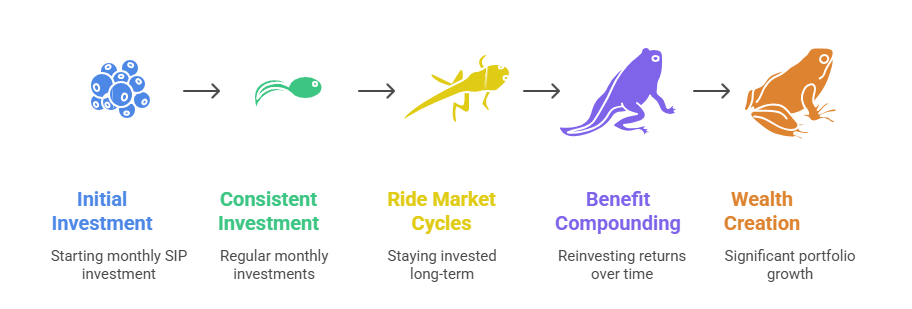

2. Leverage Systematic Investment Plans (SIPs) for Consistency

Build Wealth with Small, Regular Investments

SIPS are a crucial part of Mutual Funds growing popularity in India, allowing for regular investing, starting as low as ₹500–₹5,000/month. SIPs will benefit from rupee cost averaging, meaning even if the price is fluctuating the honest to good value will help to reduce the impact of volatility. And the use of compounding absolutely help you increase your returns over the long term.

How to Start an SIP:

- Open a DMAT account with a platform such as Groww, Zerodha Coin, or Paytm Money. Most platforms are free to open an account, no fees or minimums.

- Select the fund for your goals. For example, if you want stability, Mirae Asset Large Cap Fund.

- Start small, you can start SIP with as low as ₹1,000/month. As your income grows over the years, so can your SIP monthly contribution.

- Utilize the SIP calculators to help you estimate your potential returns. For example: if you start with a ₹2,000/month SIP and assuming an annualized return of 12% for 15 years, you could expect the SIP investment to be around ₹10,00,000.

Expected Returns: With a ₹5,000/month SIP with an equity Mutual Fund with similar returns of 12% annually, you can expect it to grow to around ₹50,00,000 in 25 years.

Also Read: 7 Budgeting Mistakes That Are Silently Killing Your Savings

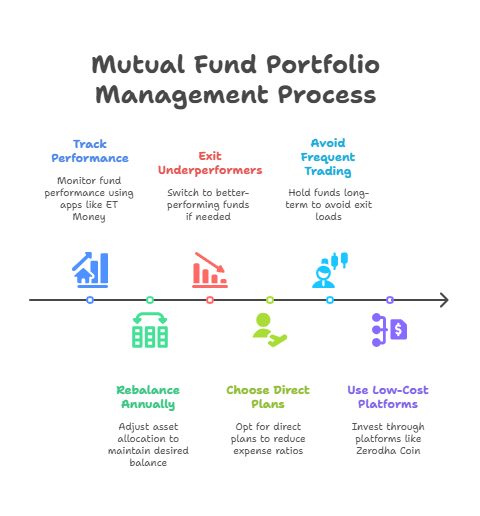

3. Monitor and Rebalance Your Mutual Funds Portfolio

Stay on Track for Maximum Returns

Regularly reviewing your portfolio will keep your investments aligned with your own objectives and circumstances in the marketplace. Rebalancing is the process of adjusting your investments so that your asset allocation remains consistent with your target allocation and investment philosophy (for example, 60% inflows in equities and 40% debt exposure) and that your portfolio is not consistently over or under weight in any asset allocation.

How to Monitor and Rebalance:

- Track Performance: Monitoring the performance of your Funds periodically (quarterly) will help you understand how each fund is performing.

- Rebalance annually: If your equity funds have outperformed so well that they are reallocated 70% equity fund units to the total fund units, you should sell some units and purchase debt funds to bring the portfolio back in line.

- Exit Performing Funds – If there is a fund that has been consistently under its benchmark (Nifty 50 for example) for 2-3 years or more, it may be time to exit and select another under the objective structure.

- Cost Guidelines– Exiting between funds of the same AMC is usually free, but you should check to see if there are any exit loads (0-1%).

Example– If you invested a lump sum of ₹1,00,000 in a mutual fund and it is now valued at ₹1,50,000; you can rebalance the portfolio by moving ₹30,000 out into a debt fund to restore it to ₹1,20,000 and ₹30,000 so that your asset allocation reflects your target allocation.

4. Minimize Costs to Boost Mutual Funds Returns

Keep More of Your Profits

High fees can affect returns in the long run. In order to maximize profit, focus on low fees, such as: expense ratios, exit loads and transaction fees.

How to reduce fees:

- Pick Direct Plans: Direct Mutual Funds have a lower expense ratio ( 0.5-1%) compared to regular plans (1.5- 2.5%). For example, a direct plan could save you ₹1,00,000 on a ₹10,00,000 without costs both plans have the same returns.

- Not to trade too often: If you redeem your units within 1-2 years, you will pay an exit load. The exit load usually ranges from 0-1%. If you want to avoid exit loads hold the funds for the long run.

- Use low-cost options: For example, several Apps like Zerodha Coin, only charge ₹0 for investments in Mutual Funds compared to almost everything traditional brokerages charge.

For example: on a ₹5,00,000 investment, a 1% lower expense ratio, means a ₹5,000 cost every year forever, with compounding.

Check Out: 9 Smart Ways to Manage Your Salary Like a Pro

5. Stay Invested for the Long Term

Let Compounding Work Its Magic

Patience is the key to success with investment. Equity are best suited for long-term investments as you will benefit from the beauty of compounding. Staying invested through market highs and lows will allow you to maximize your take from the economic growth in India.

Why long-term matters:

- Compounding: A SIP of ₹10,000 per month with 12% returns over 30 years can create ₹1,99,00,000.

- Market Cycles: Investing for 7 – 10 years allows you to take volatility in your stride and allows you to capture the upswings in the market.

- Avoid Panic Selling: During the market crash, (2020), investors who stayed invested saw their Funds value recover.

Tip: Set up auto-debit for your SIP so you don’t let emotions dictate your decisions. Money management platforms like Groww will allow you to set up auto-debits for accounts that are then automatically added for stress free investing.

Additional Tips for Mutual Funds Success in 2025

- Diversify Across Asset Classes: Spread your investments across equity, debt, and hybrid Mutual Funds to reduce risk.

- Stay Informed: Follow market trends on platforms like Economic Times (do-follow link) to make informed decisions.

- Tax Planning: Invest in Equity-Linked Savings Schemes (ELSS) Mutual Funds to save up to ₹1,50,000 annually under Section 80C.

- Use Technology: Apps like ET Money and Paytm Money offer portfolio tracking and goal-based investing tools.

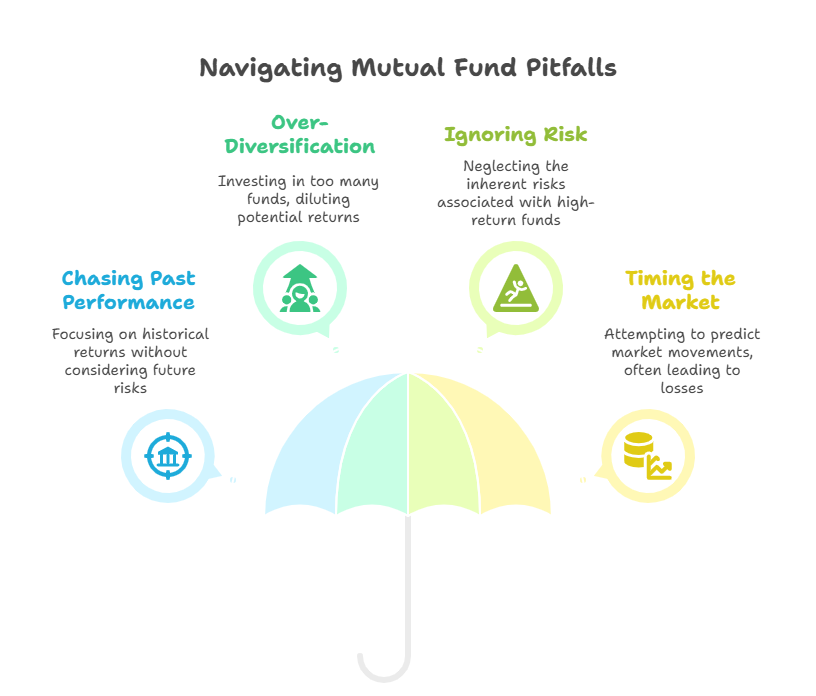

Common Mistakes to Avoid with Mutual Funds

- Chasing Past Performance: A fund’s 5-year return doesn’t guarantee future results. Focus on consistency and fund manager expertise.

- Over-Diversification: Investing in too many Mutual Funds (e.g., 15+) can dilute returns. Stick to 5–8 funds.

- Ignoring Risk: High-return funds like small-caps carry higher risks. Match funds to your risk profile.

- Timing the Market: Trying to buy low and sell high often backfires. SIPs eliminate the need to time the market.

Conclusion: Start Your Mutual Funds Journey Today

Succeeding in Mutual Funds in 2025 can be done with as little as ₹500 (or as much as ₹50,000). By selecting the right funds, taking advantage of a SIP, monitoring your portfolio, keeping your costs low, and staying invested for the long-haul, you can compound your returns and create wealth over time. That being said, now’s a great time to start investing in mutual funds because India’s economy is expanding, and the mutual funds market is booming.

Start today by opening an account with increasing popularity sites such as Groww or Zerodha Coin, starting a small SIP, and watch your wealth grow. Visit our investment blog for more tips on investing.