For many Indians, loan repayment can be a daunting task, whether you are repaying a ₹5,00,000 home loan in Mumbai, a ₹2,00,000 personal loan in Delhi, or a ₹50,000 credit card in Bengaluru. With interest rates ranging from 8% to well over 36%, the mistakes you can make in loan repayment can lead you to throw away thousands of rupees and several years of financial anguish.

In this guide, we will highlight 10 common, painful mistakes that could extend your timeline to debt freedom and provide some actionable, India-specific steps to address these issues. This guide is meant to provide valuable insights tailored to RupeeNest readers to help you become better loan-repayment specialists so you can achieve financial freedom sooner.

Table of Contents

Why Avoiding Loan Repayment Mistakes Matters

Loans are a normal means of acquiring property, automobiles, or addressing emergencies in India. However, if you mismanage your loan repayment, it can lead you down a path of debt. A simple misstep, like skipping an EMI or picking the wrong duration of a loan, can ultimately lead to costs between ₹50,000 and ₹5,00,000 over the duration of the loan. By avoiding these loan repayment mistakes, you can save money, experience less stress, and create wealth. Let’s explore the 10 mistakes and how you can resolve them.

1. Ignoring the Fine Print in Loan Agreements

Mistake: Ignoring the terms and conditions of your loan.

Impact: You might pay extra fees and charges without knowing it – Hidden fees, like processing fees (₹5,000–₹20,000) or prepayment penalties (1–2% of outstanding amount) – will ultimately increase your loan repayment price.

Solution: Read the loan agreement before you sign. For example, if you have a home loan for ₹10,00,000 and prepay the loan with a 1% prepayment penalty, you will pay ₹10,000 more, less than the 1% penalty. You can do a comparison check of terms and conditions easily through tools like BankBazaar.

Action: You should always ask for a full schedule of the loan from a bank and review for hidden fees before you sign the agreement.

Also Read: Retirement Planning: 8 Shocking Mistakes That Can Destroy Your Future

2. Paying Only the Minimum EMI

Mistake: Paying just the minimum EMI on your personal loans or credit cards.

Impact: Paying just the minimum payment each month prolongs your loan repayment time, and interest is continually accumulating. For example, if you have a credit card balance of ₹1,00,000 at 36% interest and make minimum payments of ₹5,000 per month, it takes over 3 years to pay the debt off while paying around ₹60,000 in interest.

Solution: Pay above the minimum EMI whenever you can. Even an additional ₹2,000 every month on a ₹2,00,000 personal loan at 12% saves you nearly ₹15,000 in interest. Use a repayment calculator (like the one on HDFC Bank, do follow) to visualize the savings.

Action: Make a commitment to allocate 10% of your monthly income to make additional EMI payments. For example, if your salary is ₹50,000, this adds up to ₹5,000 per month.

3. Choosing Long Loan Tenures

Mistake: Choosing the longest loan repayment option in order to minimize EMIs.

Impact: A ₹20,00,000 rate loan at 8% over 20 years will cost ₹48,00,000 in interest vs ₹24,00,000 over 10 years. Being pushed into long repayment tenures soaks up extra money into your loan repayments.

Solution: Pick the shortest term that you can afford. For example, with a ₹5,00,000 car loan at 9%, you will pay ₹50,000 less in interest over 5 years versus 7 years. You can use SBI’s loan calculator (do follow) to explore tenures.

Action: If your budget allows, consider reducing your loan tenure by 1–2 years thereby saving you several thousands of ₹ in interest.

4. Not Prioritizing High-Interest Loans

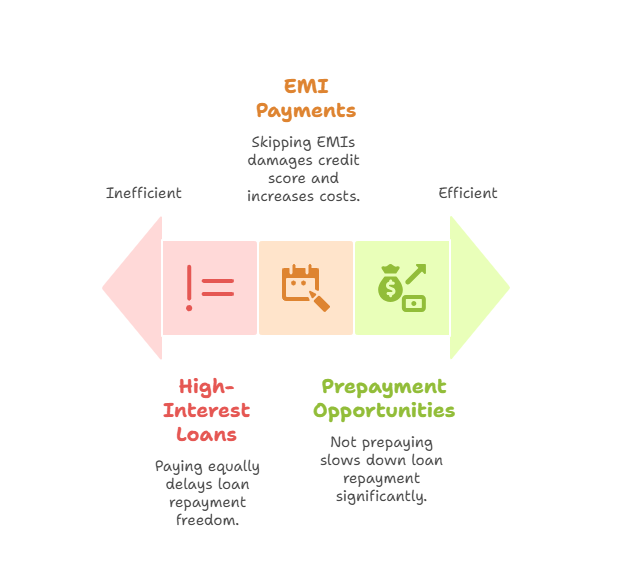

Mistake: Paying all loans instead of highest interest rate loans first.

Impact: A ₹1,00,000 credit card debt at 36% is costing ₹36,000/year in interest. Where ₹1,00,000 home loan at 8% is costing ₹8,000 yearly. The focus on these low-interest loans delays your loan repayment freedom.

Solution: Try debt avalanche method, where you pay off the highest interest loans first (so, for a credit card debt at 36% making payment of ₹10,000/month will pay the debt off much faster than you making payments proportionate among all of your loans). See what we mean by checking out how to set up smart repayments on Moneycontrol and adding the read to our emergency fund guide.

Action: Make a list of your loans by interest rate, and make sure to put any extra, additional payments on to the highest rate loan first.

Check Out: Emergency Fund Mistakes: 7 Costly Errors That Can Ruin Your Finances

5. Missing or Delaying EMI Payments

Mistake: Missing EMI payments because of cash flow issues.

Impact: Your credit score falls, and you get charged penalties of ₹500–2,000/EMI for late payments. It could further raise your cost of repayment in the subsequent loans. Let’s say you miss an EMI of ₹10,000 on your personal loan, you pay ₹1,000 penalty fee, and the next time you borrow the lender takes into account your lower credit score and charges higher interest for taking it as a risk.

Solution: Set your EMIs on auto-debit to avoid missing your due date for payment. But if you are running low on cash, reach out to your bank and negotiate if you can have an extra couple of days before the payment date where there is no penalty. You should also check RBI guidelines from the RBI website if banks are adhering to this guideline.

Action: Set auto-debit on the dates for the EMI and hold at least ₹10,000–20,000 as a buffer to get your account through emergencies.

6. Ignoring Prepayment Opportunities

Mistake: Failing to make partial prepayments when having excess cash.

Impact: A home loan of ₹10,00,000 at 8% interest over 15 years, would see a total interest expense of ₹8,60,000. An example of ₹1,00,000 partial prepayment in year 5 saves at least ₹50,000 – ₹70,000 in interest. Prepayments make the loan slip slowly.

Solution: If you get a windfall (e.g. ₹50,000 Diwali bonus), then immediately prepay one of your high-interest loans. Check first that the bank does not charge a fee for the prepayment. You can see some prepayment options on ICICI Bank. See also the articles on becoming debt-free to avoid the trap of debt.

Action: When you get a bonus or windfall income, prepay between ₹20,000-50,000 per year on high-interest loans.

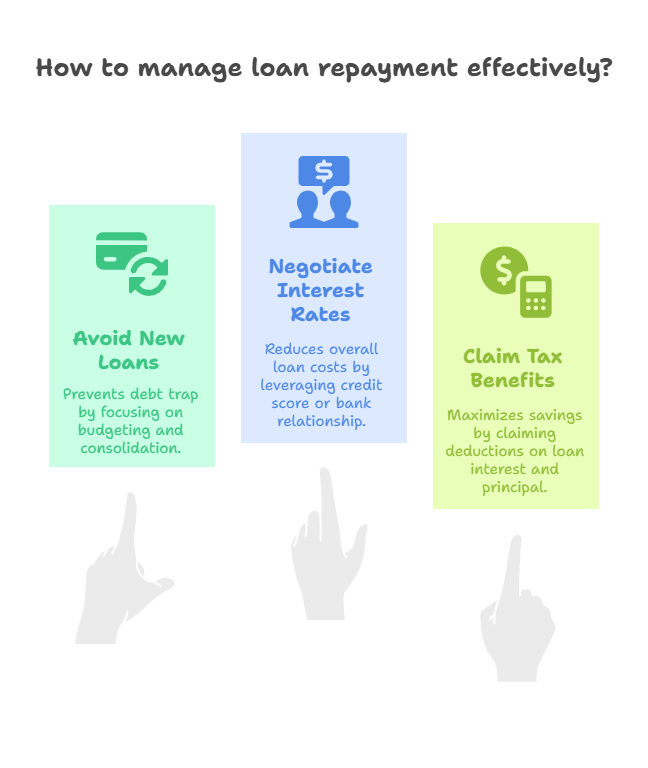

7. Taking New Loans to Pay Old Ones

Mistake: This creates a repeated cycle of borrowing money. A ₹2,00,000 personal loan at 12% to pay ₹1,00,000 credit card debt at 36% adds ₹60,000 of new interest expense over 3 years.

Solution: Avoid new loans and try budgeting or debt consolidation. Balance transfer options, like switching credit card debt to a 12% personal loan, lower interest payments. Use Paisabazaar to compare consolidation loans (do follow). Refer to our budgeting guide for more tips on cutting back expenses.

Action: Consolidate high-interest debt into one single lower-rate loan to simplify the loan repayment process.

8. Not Negotiating Interest Rates

Mistake: Accepting the lender’s original interest rate without attempting to negotiate.

Impact: A 0.5% reduction of a ₹15,00,000 home loan amount would mean savings of ₹75,000 across 10 years of loan repayment period. The lender’s original interest rate generally means you will be repaying more than you should be.

Solution: If you have a good credit score (at least 750) and / or a long-term relationship with the bank, you may be in a strong position to negotiate. For example, HDFC may drop your 8.5% home loan interest rate to 8% rate for loyal customers. A good way to deal with home loans is to use a loan tool from Axis Bank (do-follow link) which is now available. Check our watchtower for tips on getting your credit score higher.

Action: If you have an existing loan officer with your bank and a reasonable repayment history, try to negotiate down your interest rate by a min of 0.25% to 0.5%.

9. Overlooking Tax Benefits in Loan Repayment

Mistake: Not claiming tax deductions on loan interest or principal.

Impact: A ₹20,00,000 home loan with ₹2,00,000 annual interest saves ₹62,400/year under Section 24(b) (30% tax bracket). Missing this delays loan repayment by reducing disposable income.

Solution: Claim deductions under Section 80C (principal, up to ₹1,50,000) and Section 24(b) (interest, up to ₹2,00,000) for home loans. Personal loans don’t offer tax benefits, so prioritize home loan repayments. Verify eligibility on the Income Tax India website. File your ITR early to claim loan repayment deductions.

Action: Consult a tax advisor or use online tools to maximize loan-related tax deductions.

10. Not Building an Emergency Fund

Mistake: Using loans for emergencies instead of savings.

Impact: When you have no emergency fund, unforeseen costs (i.e., ₹50,000 hospital bill) means being forced into new loans and continuing to extend your loan repayment cycles.

Solution: Save up to 6-12 months’ expenses (₹3,00,000-6,00,000) in a high-interest savings account. A ₹1,00,000 emergency fund with a 6% interest rate, earns ₹6,000 per year and reduces your reliance on loans to cover emergencies.

Action: Save ₹5,000/month in a high-yield savings account to build an emergency fund.

Bonus Loan Repayment Tips

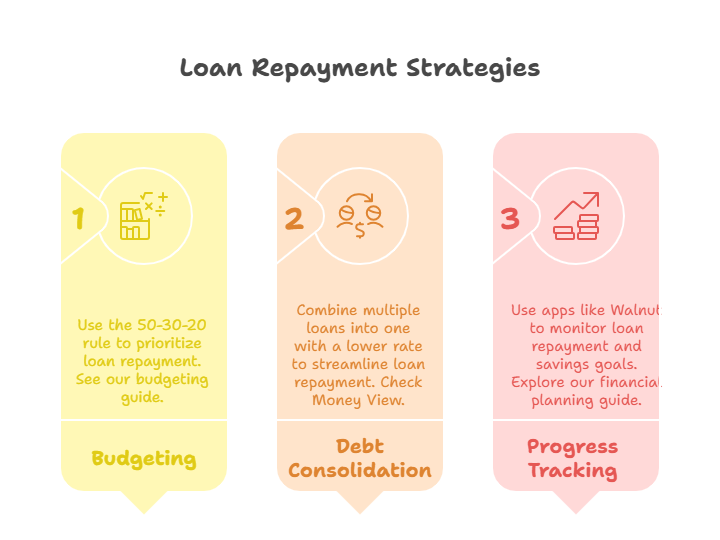

- Budget Wisely: Use the 50-30-20 rule (50% needs, 30% wants, 20% savings/debt) to prioritize loan repayment. See our budgeting guide.

- Debt Consolidation: Combine multiple loans into one with a lower rate to streamline loan repayment. Check Money View (do-follow).

- Track Progress: Use apps like Walnut to monitor loan repayment and savings goals. Explore our financial planning guide.

Conclusion: Accelerate Your Loan Repayment Journey

Struggling with loan repayments doesn’t have to be the defining feature of your financial future. When you can learn to avoid these 10 painful mistakes, you could save between ₹50,000–₹5,00,000 r in interest, pay off debts more quickly, and possibly be debt-free. Take time to examine your loan terms, focus on your most costly debts, and build an emergency fund right away. Every rupee you save is a step closer to financial freedom.

“Paying off debt isn’t just about money—it’s about reclaiming your peace of mind with every EMI.”

Ready to master loan repayment? Explore more tips on RupeeNest and share your biggest takeaway in the comments!

1 thought on “Loan Repayment Struggles: 10 Painful Errors That Delay Debt Freedom”