Every Indian dreams of financial freedom – whether you are a salaried worker in Mumbai, a small business owner in Chennai, or a student in Pune saving your first rupee. It’s about having enough money to do what you want to do in life – quitting a 9-to-5 job, travelling, or retiring early and doing whatever you want. Money should be a tool to enhance or improve your life, not what causes you stress or forces you to stay broke or stuck in life. Unfortunately, toxic perceptions about money and financial freedom often lead people around our country into an endless cycle of financial stress. Which is sad.

In this guide, I will dispel 9 toxic myths about financial independence that keep you blocked, and share some practical advice that is specific to India that can help you build wealth and wealth creation in a sustainable manner. Let’s demolish these myths and build your journey from wherever it exists to financial independence!

Table of Contents

Why Busting Financial Freedom Myths Matters

In India, increasing financial pressures and prices can make it challenging to save. Believing in the myths of financial freedom can distract you from your goal. From wanting to get rich quick to being afraid of investing, these myths cost you lakhs over time. Once you understand how to counter these myths, you will be far better prepared to save, invest and expand your wealth, regardless of the amount whether it is ₹10,000, ₹1 crore or anywhere in between. Join me to look at the 9 toxic beliefs, what the implications are, and how to combat them.

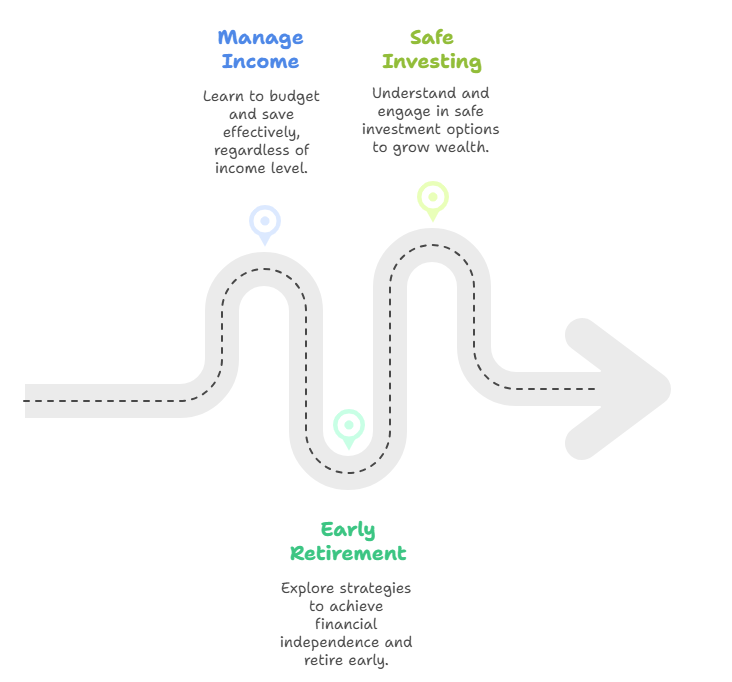

1. Financial Freedom Requires a High Income

Myth: You need a ₹1,00,000+ monthly salary to achieve financial independence.

Truth: Financial independenceis not about your income, it’s about your wealth management. A software engineer in Bengaluru earning ₹50,000/month with good financial habits can potentially save more than someone earning over ₹2,00,000/month with poor habits.

Try the below suggestions to help you develop some good money habits:

- First, start budgeting: follow the 50-30-20 rule; 50% of income towards “Needs”, 30% towards “Wants” and lastly 20% towards Savings/Investments. For example, ₹10,000/month into savings/mutual funds earn 8% a year, should get you to ~₹15,00,000 in 20 years’ time. We highly recommend trying apps like Zerodha Coin to help you get started into investing.

Action: Track your expenses this month with apps like Moneycontrol; after you’ve managed your expenses, invest back ₹5,000 to ₹10,000 back into your investments!

2. You Must Work Until 60 to Achieve Financial Freedom

Myth: Financial independence only applies to retirees with a ton of savings.

Truth: The FIRE (Financial Independence, Retire Early) movement shows that you can achieve financial freedom in your 30s or 40s, by saving between 50–70% of your income consistently and investing in high return assets such as mutual funds (12–15% returns).

For example, if you save ₹20,000/month at 12% returns, in 20 years you will have ₹1 crore. Look at the FIRE strategies on Mr Money Mustache , and combine this with our retirement planning guide.

Action: Find a way to improve your savings rate by slashing non-essential spending such as eating out (₹2,000–5,000/month).

3. Investing Is Too Risky for Financial Freedom

Myth: Stocks and mutual funds are a form of gambling, you are going to lose money.

Truth: Investing your money is critical for financial independence. Stocks are risky, but investing in diversified mutual funds, or index funds (like the Nifty 50), have an average return of 10-12% over 10 years or more.

- For example, ₹5,00,000 would grow to ₹15,50,000 if you invested in a Nifty 50 mutual fund at 12% for 10 years.

- Start off with safer options like PPF (Public Provident Fund), which is up to 7% returns, or use Groww and invest in equity funds (high risk).

Action: Begin a monthly SIP (Systematic Investment Plan) of ₹5,000/month into a diversified equity fund to help build your wealth safely.

4. You Need a Big Lump Sum to Start Your Financial Freedom Journey

Myth: You need ₹10,00,000+ to get started to invest and achieve financial freedom.

Truth: Small, consistent investments compound over time. A SIP of ₹5,000/month in an ELSS fund grows at 12% over a period of 20 years, saving you ₹46,800/year in taxes under Section 80C, to ₹22,00,000.

- You can start SIPs on app-based platforms like ET Money (do-follow) and put in as little as ₹500. Check out our tax saving guide for more.

Action: Start with ₹1,000/month and into a mutual fund, and then increase your investment every month as your salary grows.

Also Read : 7 Proven Ways to Save More Every Month

5. Debt Prevents Financial Independence

Myth: All debt (like a mortgage) destroys dream of being financially free.

Truth: Good debt, like a mortgage at 8–9% interest, can create wealth when properly managed. For instance, a ₹50 lakh mortgage at ₹2,00,000 annual interest allows you to save ₹62,400 in taxes (Section 24(b), 30% bracket) while accumulating an appreciating asset.

- You’ll want to avoid high-interest debt like credit cards (36%+ interest). Just learn how to manage your debt using our guide for living debt-free. Once you’ve got it figured out, loan comparison sites like BankBazaar (do-follow) can help you find a loan that best suits your needs.

Action: Pay off high-interest debt first (e.g. if your credit card has a ₹10,000/month balance) so you can use the resulting cash flow to invest.

6. Financial Freedom Means Never Working Again

Myth: Financial independence means never having to work again.

Truth: Being financially free is about options, not just doing nothing. It also means being able to do work you enjoy, like starting a side hustle or freelancing, without the financial pressure.

For example, if you had a passive income of ₹50,000/month from your investments (let’s say ₹1 crore in mutual funds at a 6% withdrawal rate), you could pay your living expenses in most Indian cities.

Action: Build a side income of ₹5,000–10,000/month to allow for your diverse income streams.

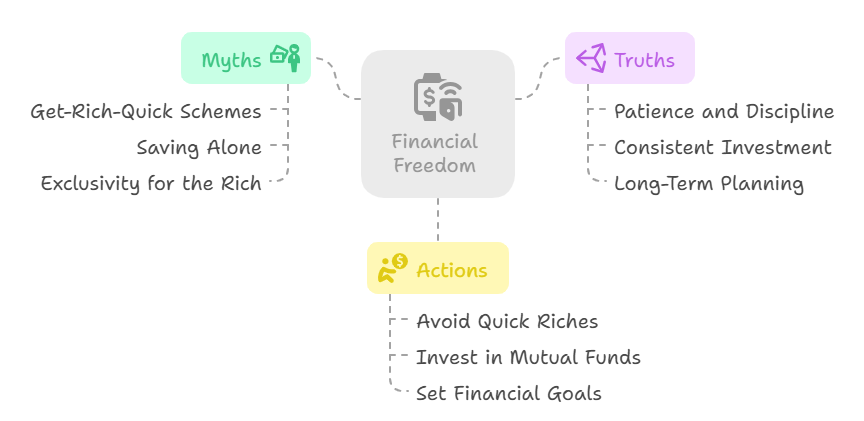

7. You Can Achieve Financial Freedom Overnight

Myth- Quick-rich schemes like crypto trading can give you financial independence.

Truth- Financial freedom takes time and discipline to achieve. Scam services that assure returns like 100% typically lead to financial losses. The way forward is to invest systematically in well-established investment products (like a mutual fund or contribution in a fixed deposit) to create wealth. For example, by investing ₹10,000 a month in an FD yielding 7% return, over a period of 20 years, you will have created ₹36,00,000 fund.

You can also familiarize yourself with “scams” on the RBI’s website and see how to avoid them and safely invest through our emergency fund guide.

Action: Avoid get-rich-quick-private schemes, that never work out, and invest for the long term.

8. Saving Alone Leads to Financial Freedom

Myth: Simply saving cash in a savings account will provide me the financial freedom I desire.

Truth: Saving accounts usually pay about 3−4% interest while India’s prevailing inflation rate is 6−7%. While this should help, in general you are losing inflation-adjusted value with every year you keep that money in a savings account.

For example, if you put ₹1,00,000 in a savings account earning 3% interest with an inflation rate at 7%, you are losing about ₹3,000 per year in real value! And if you put that money in mutual fund or stocks, you could be earning 10−12% in returns, effectively beating inflation.

Action : Move ₹50,000 from your savings account to a mutual fund for improved investment performance.

Check Out : Best Side Hustles in India to Make Extra Income

9. Financial Freedom Is Only for the Rich

Myth: Only millionaires can gain financial freedom.

Truth: Anyone with some discipline can achieve financial freedom. A person earning ₹30,000/month; saving the 20% of it or ₹6,000/month at 10% returns will have ₹45,00,000 after 25 years. That is more than sufficient income for core pension for retirees in tier-2 India.

- Start with a smaller goal and then grow. Check out Moneycontrol to avail there financial planning tools. Look into our blogs to see retirement planning tip which we believe can help.

Action: Define a financial freedom target, (e.g. ₹50,00,000 corpus, ) and create a saving plan.

Bonus Tips to Break Free from Financial Freedom Myths

- Track Your Progress: Use apps like Walnut to monitor expenses and savings, ensuring you stay on the financial freedom path.

- Learn Continuously: Read books like Rich Dad Poor Dad or follow Paisa Vaisa podcast (do-follow) for financial wisdom.

- Build an Emergency Fund: Save 6–12 months’ expenses (₹3,00,000–6,00,000) to avoid dipping into investments. See our emergency fund guide.

Conclusion: Rewrite Your Financial Freedom Story

These 9 financial freedom myths—from needing high income to not investing—are all financially crippling (or mentally stressful) for the millions of Indians striving for financial freedom. Once you unravel the truth behind these myths, you can take charge of your finances, whether you are saving ₹5,000/month, or ₹50,000. Start small: spend prudently, invest regularly, and stay away from get-rich-quick schemes. With patience and perseverance, financial freedom can be achieved so you can live life on your own terms.

So, are you ready to start building wealth now? Look for more tips on achieving financial freedom on RupeeNest and don’t forget to leave your biggest “myth debunked” takeaway in the comments below & let’s get every rupee working for you!

1 thought on “Financial Freedom Myths: 9 Toxic Beliefs That Keep You Broke”