An emergency fund is fundamentally a financial safety net for unexpected expenses, such as emergencies involving medical issues, job loss, or when urgent repairs are required. In India, because there are ample number of uncertainties surrounding neighbourhood problems, and rising prices, an emergency fund may not be a choice, but a critical priority. However, there are a great number of people that make the same irreversible mistakes that can cause financial calamity in establishing or pulling funds from their emergency fund. In this article, we identify seven emergency fund mistakes to avoid at all costs–the concept of financial certainty.

Table of Contents

Why an Emergency Fund Is Crucial in India

Life is full of surprises, and you never know when a financial emergency will arise. A financial emergency can be anything from an unexpected medical bill, a car issue, a sudden loss of income, etc. An emergency fund acts as a buffer in situations like this so you can handle your financial emergency without too much disruption to your savings or investment accounts and without tapping into credit cards or loans.

Personal finance professionals say that you should save a minimum of 3 months to 6 months of living expenses in an emergency fund. This amount could be anywhere between ₹1,50,000 to ₹6,00,000 for the average Indian household depending on lifestyle and place of residence.

Unfortunately, a lot of Indians have an last minute fund but fail to manage it correctly or they don’t have an emergency fund at all, which can result in pricey consequences. Let’s take a look at the seven most common emergency fund mistakes and how you can avoid them.

Mistake 1: Not Having an Emergency Fund at All

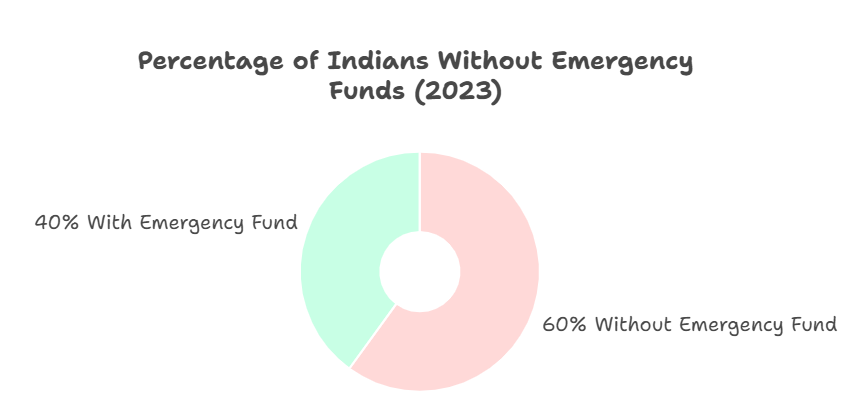

The worst mistake is actually not having an emergency fund. The LiveMint survey of 2023 showed that almost 60% of Indians do not have any emergency savings. Without some sort of emergency fund, something unforeseen just a little expense could end up causing you to go into debt or selling off some long-term investments, thereby abandoning your goals.

How to avoid: Start small but start today. You can save as little as ₹5,000 a month and end up with 60,000 a year. Open a separate bank savings account or a liquid mutual fund account for your emergency fund. Set up automatic deposits into the emergency fund account with savings plan such as a recurring deposit or Systematic Investment Plan. Learn how to start saving with our Personal Finance Guide.

Mistake 2: Keeping Your Emergency Fund in Risky Investments

Some individuals incorrectly invest their fund into stocks, equity mutual funds, or cryptocurrencies in the hope of earning a higher return. Though these investments may increase in value over the long run, they are extremely volatile instruments that lose value in most cases when you need the cash most. For example, say you need ₹2,00,000 for a medical emergency but your fund to draw from just dropped by 30% because markets tanked.

How to avoid: Keep the fund in liquid, safe instruments such as high-yield savings accounts, fixed deposits, and/or liquid mutual funds. These options will allow you to access your fund easily and will be risk-adjusted. Let’s say the savings is generating ₹3500 per annum interest with a 3.5% interest rate or the liquid fund is generating ₹12,000 annually with a 6-7% yield. Your money will be safe and available when you need it. You can learn all about these safe investment options in our Guide to Safe Investments in India.

Also Read: Ways to Build Wealth on a ₹30K Salary.

Mistake 3: Underfunding Your Emergency Fund

Most people don’t realize how much they truly need in their emergency fund. If your monthly expenditures are ₹50,000, simply having your ₹50,000 means you are in danger of losing that allotment of funds in, say, a spontaneous hospital stay, or losing your job. In India, hospital stays and other medical procedures can easily cost north of ₹1,00,000;

How to Avoid: The ache of the punch through the gut of being underfunded can add-up in many individuals. You most likely will going to want to try and 3 – 6 months of basic living expenses stored away in savings. Health issues and job losses have no bound on time, individuals may want to save more of a buffering amount if one’s engaged in self-employment or other fields which may feel unstable to them because of the time they’re employed, and the potential of a job loss.

For individuals who have needed (rent as an expense), a family with something around, for example, ₹75,000 of expenditures still means it is reasonable to have an emergency fund of somewhere like, ₹2,25,000 to ₹4,50,000. Take a moment to calculate what your ongoing expenditures are, rent, groceries, EMIs, utility, etc. and set a realistic savings target for your.

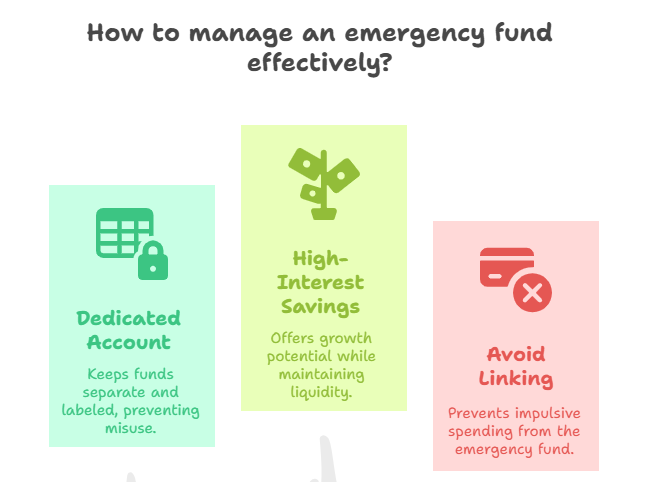

Mistake 4: Mixing Your Emergency Fund with Other Savings

Mixing this fund with your regular savings/money leaves you open to unnecessary spending. You’ll use it for things that aren’t emergencies — like a new phone or going on vacation. When a legitimate emergency arises, you will not have been practicing saving for emergencies, and you may likely find yourself in a catastrophe!

How do you avoid this? Open up a savings or liquid fund specifically for this fund. Name it “Emergency” or something similar. You are not encouraged to link this account to your debit card, UPI, etc. Look into banks such as Kotak or HDFC, which offer high-interest savings accounts with easy access. If you want some further advice in organizing your finances, check out our Budgeting Tips for Indians.

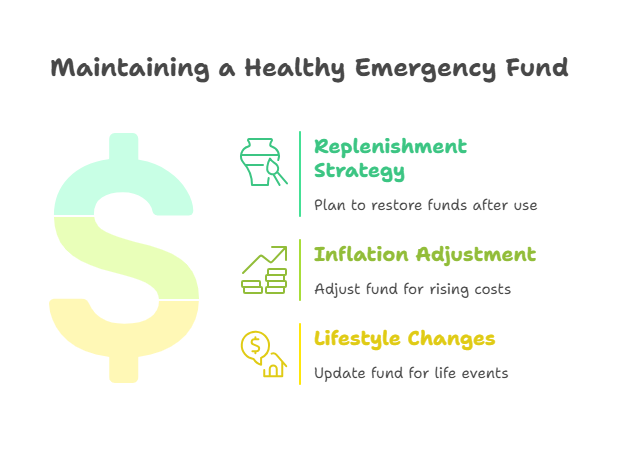

Mistake 5: Not Replenishing Your Emergency Fund After Use

While emergency funds are designed for emergencies, neglecting to add it back can leave you vulnerable. For example, if you took out ₹1,00,000 from your emergency fund to pay for a medical bill, you could put yourself in a bad position when the next emergency hits if you don’t put it back.

How to avoid: Think of an emergency fund like a loan to yourself – a loan where you’re accumulating interest at the rate of your salary. After you take out from the fund, plan on putting it back. If you take ₹50,000 out, then plan on saving ₹5,000 for 10 months to restore the fund. Be sure to do this before you spend any discretionary income.

Check out: 7 Budgeting Mistakes That Are Killing Your Savings.

Mistake 6: Ignoring Inflation and Lifestyle Changes

Your emergency fund needs to evolve with your life. If you built a fund of ₹2,00,000 five years ago, inflation and lifestyle changes (e.g., marriage, kids, or moving to a metro city) may have made it insufficient. In India, inflation averages 5-6% annually, meaning ₹2,00,000 today could be worth only ₹1,50,000 in real terms after a few years.

How to Avoid: Review your fund annually. Adjust it for inflation and life changes like a new job, marriage, or children. If your expenses have risen from ₹40,000 to ₹60,000 monthly, increase your fund from ₹2,40,000 to ₹3,60,000. Use Inflation Calculator to estimate future costs.

Mistake 7: Relying Solely on Credit for Emergencies

Some people fail to prioritize an fund because they feel they can depend on credit cards or loans to cover unexpected emergencies. While credit can certainly be a stop gap solution for emergencies when you run out of cash—it’s certainly NOT an ideal solution—and the credit route comes with big interest rates (1-3% PER MONTH or approx. 12-36% a year in India!). So that ₹1,00,000 medical loan at 15% interest could cost you an extra ₹15,000 in just a year.

How to avoid: Build an actual fund, so you don’t have to count on your credit cards. If credit cards are your only options, do your best to pay immediately to avoid accumulating interest. Having an emergency fund is just one piece of long-term financial stability; insurance will help reduce your out-of-pocket expenses for unplanned expenses (non-discretionary), and combine it with your emergency fund for twice the peace of mind. If you’re interested, switch to no- or low-cost insurance (health, life, and vehicle) through companies like Policybazaar.

Tips to Build and Maintain a Strong Emergency Fund

- Start Small: Even ₹1,000 a month adds up over time.

- Choose Liquid Assets: Opt for savings accounts, fixed deposits, or liquid mutual funds for easy access.

- Automate Savings: Set up auto-debits to ensure consistent contributions.

- Monitor Regularly: Check your fund every 6-12 months to ensure it meets your needs.

- Avoid Temptation: Keep your fund separate from daily spending accounts.

For more practical advice, explore our Financial Planning Guide.

Conclusion

Establishing and maintaining an emergency fund is an essential part of being financial secure and stable in India. After avoiding these seven big mistakes, which are not having an emergency fund, borrowing money to fund a lifestyle, not having enough in the fund, not keeping the cash in an emergency fund separate, not replacing the fund as spent, not considering inflationary shock, and relying on credit, you will be able to shield your finances from unforeseeable shocks and bumps in the road of life. Initiate as soon as you can, continue saving regularly, and periodically review the emergency fund amount to ensure your fund stays in step with your emergency needs. Your future life will thank you!

Do you have any questions about how to create your fund? Post them in the comments section or visit our Personal Finance Blog for more.

1 thought on “Emergency Fund Mistakes: 7 Costly Errors That Can Ruin Your Finances”