If you want a secure future, you need financial planning. However, planning is difficult, and many Indians are used to making mistakes when they try to plan. With costs on the rise, and unexpected expenses popping up everywhere, you can see why it would be easy to shrug your shoulders and simply accept whatever results your finances become. However, without the proper planning, you could end up wasting opportunity, ruining your finances, and ruining your future.

In this article, we will uncover the main reasons why most Indians fail at financial planning and present straightforward and actionable advice to fix the issue. The advice presented here will be weighted towards the specific problems faced by Indians households and is intended to help you take control of your personal finances without feeling overwhelmed today, remembering we will use rupees amounts in calculations.

Table of Contents

Why Financial Planning Matters in India

Financial planning is not the same for everyone, and in a diverse country like India, achieving a successful financial life is often more difficult. People from young professionals in metro cities to families in Tier-2 towns all face very unique challenges. Some of the challenges include saving money to pay for a child’s education, planning to buy a home, and if you are ever to retire. Having a good financial plan enables you to be ready for life’s milestones. Too often, however, we allow our culture, lack of education & awareness, and mistakes we all make to sabotage our financial plans. Let’s look into the reasons why we struggle in India, and how we can improve.

Common Reasons Indians Fail at Financial Planning

1. Lack of Clear Financial Goals

One of the biggest hindrances to financial planning is a lack of clear and specific plans. A lot of money is lost by Indians saving without a financial planning; whether it’s saving to purchase gold or putting money away in poor yielding savings accounts, if you don’t have a plan, it’s easy to do. To using an example as reference, if you save ₹5,000 a month, but have no financial target in place; whether it’s a house, your children’s education or retirement, it’s possible goals can be missed.

The remedy: Identify your short, medium and long-term goals (1–3 years; 3–7 years; 7+ years). An example is saving ₹5 lakh towards a car in 3 year; or saving ₹20 lakh for the purchase price for a house is a good target in 7 years. Use the goal-setting tool – Moneycontrol’s Financial Planning Calculator to plan your goals.

Check out: Guide on setting financial goals to get started.

2. Over-Reliance on Traditional Investments

Indians are known to cherish gold and fixed deposits (FDs) for saving but depending on these investment choices will limit the future growth potential of their investment portfolios. Gold prices are volatile, and fixed deposits yield returns in the range of 5–7% (for example, ₹7,000 in annual interest per year on a ₹1 lakh fixed deposit in India at 7%), often less than inflation rates of 4–6%.

Fix It: Invest in options outside of gold and FDs. Consider diversification through mutual funds or systematic investment plans (SIPs) using online sites like Zerodha. For example, if you set up a ₹5,000 monthly SIP in an equity mutual fund with an average return of 12%, your investment could grow to 12 lakh after 10 years, much greater than any fixed deposits would yield. Find out more about investment opportunities from readers in our valuable article on smart investing.

3. Ignoring Emergency Funds

Surprise expenses such as medical emergencies or job loss can interfere with financial planning. Many Indians do not have an emergency fund and may end up with debt, or tapping into long-term savings. A single hospital bill of ₹2 lakh could end up throwing away years of savings if someone is not prepared.

What You Can Do: Put together an emergency fund based on your monthly outgo over 6-12 months. If you spend ₹30,000 a month, aim for anywhere between ₹1.8 – ₹3.6 lakh. Aim for minor steps at first: set aside ₹2,000 a month in a liquid mutual fund through a platform such as Groww. Refer to our emergency fund article for many more suggestions.

4. Underestimating Insurance Needs

Many Indians do not purchase coverage or underinsure themselves, especially with regard to health and life insurance. In many cases, it can be seen that for health insurance, for example, a ₹5 lakh health cover might be adequate, but it can fall short for critical illnesses charging ₹10–20 lakh in a metro hospital.

Fix It: Buy comprehensive health insurance with at least ₹10 lakh coverage through a provider like Policybazaar. For life insurance, consider a term plan with coverage of 10–15x your annual earnings. In the case of someone earning ₹5 lakh a year, they could buy a ₹50 lakh term plan for only ₹500–1,000 per month.

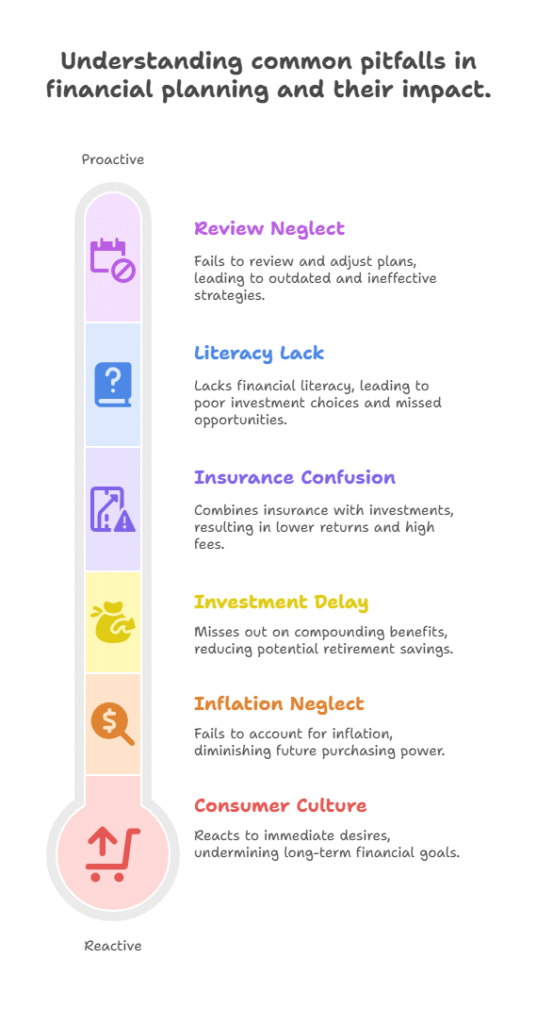

5. Impulse Spending and Lifestyle Inflation

India’s growing consumer culture fuels impulse buys and lifestyle inflation. Upgrading to a ₹15 lakh car when a ₹7 lakh model suffices or splurging ₹10,000 monthly on dining out can sabotage financial planning.

Fix It: Follow the 50/30/20 budget rule: 50% for needs, 30% for wants, and 20% for savings. Track spending with apps like Walnut (do-follow) to spot leaks. For instance, cutting ₹5,000 monthly dining expenses saves ₹60,000 annually. Explore our budgeting tips for more strategies.

6. Not Accounting for Inflation

Inflation reduces purchasing power, and yet even with the expansive financial products, many Indians still ignore it in their financial planning. A child’s education costs ₹10 lakh today (for reasonable education). The ten-year future value of the ₹10 lakh education cost …………. at 6% inflation, would be ₹18 lakh in 10 years.

A Solution: Options that will allow you to outpace inflation include choice of equity mutual funds, and Public Provident Fund (PPF). If you put away ₹5,000 on a monthly basis from now until them with the PPF at 7.1%, you will have ₹15.5 lakh in 15 years. You may want to use SBI’s PPF Calculator to see if your plan is reasonable.

7. Procrastination in Starting Investments

Postponing investments is a quiet assassin in financial planning. Everybody knows, timeliness is everything, yet, delaying to begin an ₹5,000 monthly SIP investment at age 25 or 35 means a difference of ₹1 crore in retirement and that is down to compounding!

Fix It: Just get started! You can even start with a small ₹500 monthly SIP via platforms like ET Money. The sooner you start the more your money can make money.

8. Mixing Insurance with Investments

Many Indians fall for insurance-cum-investment plans like ULIPs, which offer low returns (4–6%) and high fees. A ₹1 lakh annual premium ULIP may yield less than a pure mutual fund over 10 years.

Fix It: Separate insurance and investments. Buy a term plan for coverage and invest in mutual funds for growth. Platforms like ClearTax can help compare options.

9. Lack of Financial Literacy

A lack of knowledge about financial planning tools and options is a major hurdle. Many Indians don’t understand mutual funds, stocks, or tax-saving instruments like ELSS, leading to poor decisions.

Fix It: Educate yourself through free resources like Moneycontrol or YouTube channels like CA Rachana Phadke Ranade. Spend 30 minutes weekly learning.

10. Not Reviewing Plans Regularly

Financial planning isn’t a one-time chore. Life happens with changes like marriage, children and job changes, and financial plans need to be adjusted. Not reviewing your financial plan at least once per year will leave you straying away from your financial objectives with outdated plans.

Fix: Implement quarterly reviews to adjust budgets, investments and goals. Use apps like Mint (do-follow) to track and review progress. For example you got a ₹10,000 increase in salary, instead of spending it, direct it to savings.

How to Build a Financial Plan

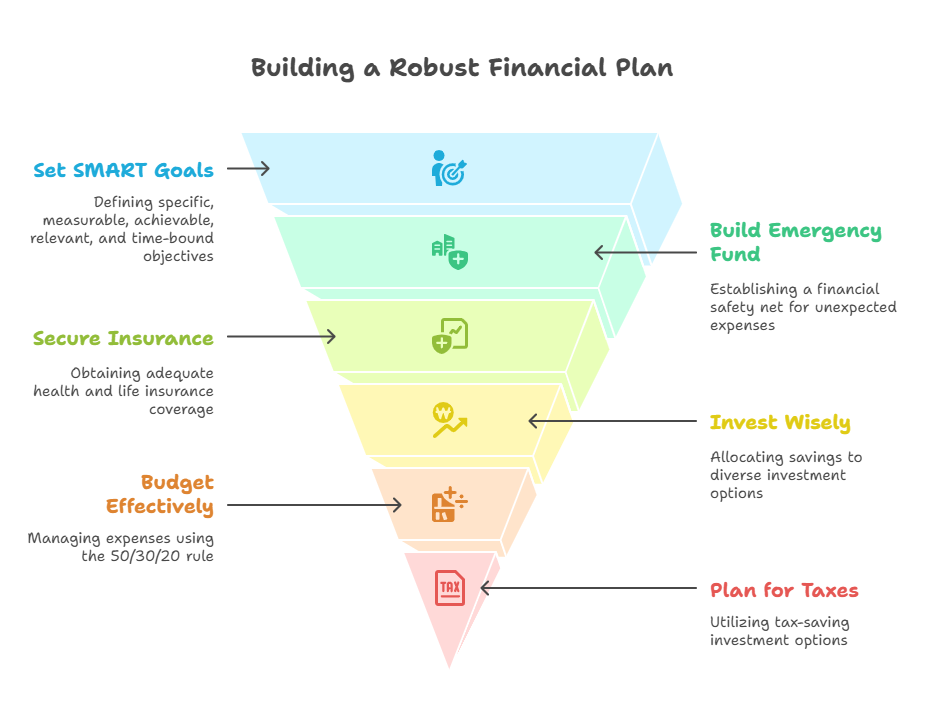

Now that we’ve covered why Indians fail at financial planning, here’s a step-by-step guide to create a robust plan:

- Assess Your Current Finances: List income, expenses, assets, and debts. For example, if your monthly income is ₹50,000 and expenses are ₹40,000, you have ₹10,000 to save or invest.

- Set SMART Goals: Make goals Specific, Measurable, Achievable, Relevant, and Time-bound. Example: Save ₹10 lakh for a home down payment in 5 years.

- Build an Emergency Fund: Aim for ₹1–2 lakh initially, stored in a savings account or liquid fund.

- Get Adequate Insurance: Secure health (₹10 lakh+) and term life insurance (10x annual income).

- Invest Wisely: Allocate savings to PPF, mutual funds, or stocks. A ₹5,000 monthly SIP can grow significantly over time.

- Budget Effectively: Use the 50/30/20 rule and track spending with apps like Moneycontrol

- Plan for Taxes: Invest in ELSS funds or PPF to save up to ₹1.5 lakh annually under Section 80C. Check ClearTax (do-follow) for tax-saving options.

- Review Annually: Adjust your plan for life changes or market shifts.

Conclusion: Take Control of Your Financial Future

Financial planning is not the scary beast that most people make it out to be. It is possible to create a safe and secure future by tackling the main issues of unclear goals, procrastination, and financial illiteracy! Don’t overwhelm yourself… Take it one step at a time! Maybe focus on setting one goal today, or opening a SIP, or reviewing your budget today. Once you address those areas, you could turn what could have been financial failures to massive successes.

Which financial planning tip are you going to try first? Do share your thoughts or look at other personal finance tips on our site!

“Financial planning is not about restricting your life; it’s about empowering your dreams with every rupee you save.”

2 thoughts on “Urgent Alert: Why Most Indians Fail at Financial Planning and How to Fix It”