Ways to save money is a goal many of us chase, especially in a country like India where a rupee saved is a rupee earned. With everything steadily going up, there seem to be infinite temptations before us as well, making saving often seem more like an act of sacrifice and less like a goal. What if you could eliminate some of your spending without feeling like you are sacrificing?

This article shares 10 smart, practical ways to save money which are smart, practical strategies that enable you to live the lifestyle you want while preparing your future interested self the financial security you deserve. This article will outline everything from micro-changes that save minor amounts of money, to substantial changes that can save you large amounts of money. These tips and strategies are designed for Indian households in the context of proven, practical, money saving strategies.

Table of Contents

Why Saving Money Matters in India

It’s important to find ways to save money, especially in India where the cost of living differs from city to city and inflation can be sneaky. Whether you’re a salaried professional living in Mumbai or a small business owner in a tier-2 city, getting more out of your income means you get to do things that help you achieve your goals of buying a house, paying for education, or even just promoting saving for retirement.

The good news is that you don’t need to completely deprivation yourself from those cups of chai or outings with friends on the weekends, Let’s dive into 10 actionable ways to save money without feeling like you’re missing out.

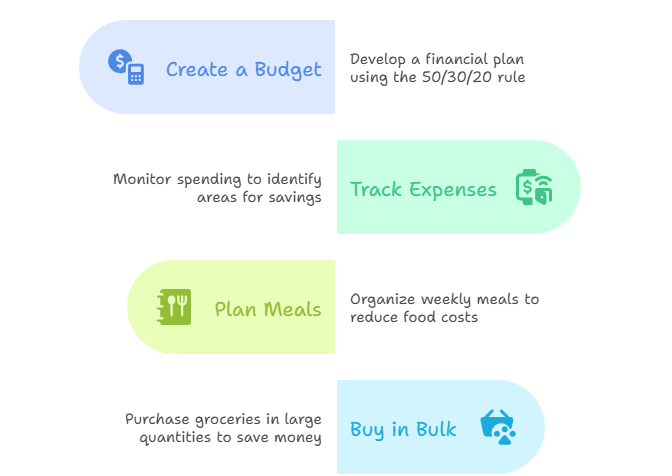

1. Create a Budget That Feels Like a Game Plan

One of the best ways to save money is to have a budget! A budget is not about limiting your spending, it is about clarity! Utilize the 50/30/20 rule: 50% of your income for necessities (rent, groceries), 30% for wants (dining, entertainment), and 20% savings or paying off debt.

How to get started: Use a budgeting app like Moneycontrol, or a simple Excel sheet, etc. Suppose your monthly income is ₹50,000, if so you should aim to save ₹10,000, spend ₹25,000 on necessities, and keep ₹15,000 for fun. Track your spending for a month to see where your leaks are, e.g., that extra Swiggy order!

Check out – Creating a personal budget to take control of your finances.

2. Cook Smart, Save Big

Food is a significant cost in Indian households, but you do not have to choose between enjoying your favourite biryani to save money. One of the smartest ways to save money is to cook at home strategically. When you kitchen at home, this also becomes one of the best ways to save money. You can plan meals for the week and buy what you need in bulk from local markets or an online retailer like BigBasket. For example, purchasing staples – rice, dal, and spices in bulk can save you ₹500 – ₹1000 per month.

Pro Tip: Prepare meals on weekends in batches to avoid ordering food deliveries due to impulse. Buy a pressure cooker or air fryer to speed up cooking and your food will still be healthier. You will enjoy home-cooked meals while saving money without deprivation!

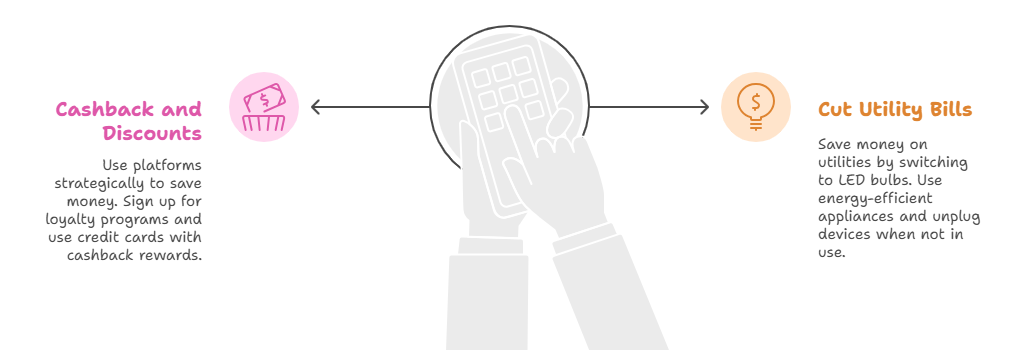

3. Embrace the Power of Cashback and Discounts

India is experiencing a digital economy boom, supported by cashback and discount offers on online shopping platforms. From electronics to groceries and everything in between, there are plenty of deals available via platforms like Amazon India (do-follow) and Paytm. One of the easiest ways to save money is to use these platforms.

How to Implement: Sign-up for loyalty programs, shop with cashback credit cards and shop sales like the Great Indian Festival. For instance, suppose you buy a smartphone for ₹10,000 and receive a 10% cashback on that purchase, you will save ₹1,000 immediately. Remember to check prices on aggregator applications like PriceDekho before you purchase.

4. Cut Utility Bills Without Sacrificing Comfort

Utilities—electricity, water, and internet—can take a big chunk out of your budget! Finding ways to save money on utilities is easier than you think. You can reduce electricity usage by utilizing LED bulbs, which can save a small household up to ₹2000 in electricity a year. You can also buy more energy-efficient appliances, and unplug items you aren’t using.

Quick Win: Choose a prepaid plan for your mobile instead of a postpaid plan to avoid unexpected bills. For instance, if you purchase Jio’s ₹299 plan, which includes unlimited calls and data, you can save ¥100 – ₹200 a month over a postpaid plan.

5. Shop Second-Hand for Big-Ticket Items

Buying pre-owned items is one of the most underrated ways to save money. In India, sites like OLX and Cashify provide quality second-hand electronics, furniture, and even vehicles at a fraction of the price. What a win to pay ₹20,000 for a used laptop instead of ₹50,000!

How to Shop Smart: Verify seller’s legitimacy and inspect in person before purchasing. This way, you get quality products without the hefty price tag.

6. Use Public Transport or Carpool

Fuel and transportation costs can add up, especially in cities like Delhi or Bangalore. One of the best ways to save money is to use public transport like metro trains or buses. For example, a monthly Delhi Metro pass costs around ₹1,500, compared to ₹5,000+ on fuel for daily commutes.

Alternative: Carpool with colleagues or use apps like Quick Ride (do-follow) to split fuel costs. You’ll save ₹2,000–₹3,000 monthly while reducing your carbon footprint.

7. Negotiate Like a Pro

Bargaining is an art form in India. Be it at a local market or with a service provider, bargaining is an effective way to save money. Bargain on polite terms for everything from clothes to annual gym memberships. For example, by negotiating the gym membership cost from ₹12,000 to ₹10,000, you have saved ₹2,000 instantly.

Pro Tip: Prior to negotiation, know what the local market prices are so that you are in a stronger position to bargain. Read our negotiation tips to hone your skills.

8. Invest in Low-Cost Entertainment

Entertainment doesn’t have to be expensive. One of the greatest fun ways to save money is to find affordable options. There are so many things to choose from. Instead of buying that movie ticket for ₹500, paying for an OTT service like Netflix India (do-follow) or Hotstar for ₹299–₹1,499 a year. You can also have a game night at home or go to free local events like a cultural festival.

Budget Hack: You can get more money saving by splitting your subscriptions with family or friends. For example, a ₹1,499 Netflix plan shared across 4 people costs ₹375 a year.

9. Automate Your Savings

Saving feels effortless when it’s automatic. One of the smartest ways to save money is to set up a recurring deposit (RD) or systematic investment plan (SIP). For example, an RD with a bank like SBI (do-follow) lets you save ₹1,000 monthly at 6–7% interest, growing your money over time.

How It Works: Instruct your bank to transfer a fixed amount (e.g., ₹2,000) to a savings account or mutual fund right after your salary credits. This “pay yourself first” approach ensures savings without temptation. Learn more in our guide to smart investing.

10. DIY Whenever Possible

From home repairs to gifts, doing it yourself is a fantastic ways to save money. Instead of paying ₹500 for a plumber to fix a leak, watch a YouTube tutorial and do it yourself for ₹100 in materials. Create handmade gifts or cook special meals instead of buying expensive presents.

Get Started: Platforms like WikiHow (do-follow) offer step-by-step guides for DIY projects. You’ll save ₹1,000–₹5,000 annually while learning new skills.

Bonus Tip: Review and Adjust Regularly

Saving money isn’t a one-time task. Revisit your budget and expenses every 3–6 months to find new ways to save money. Maybe you can switch to a cheaper internet plan or cancel unused subscriptions. Regular reviews keep your finances on track without feeling restrictive.

Check out – our personal finance checklist to stay organized.

Conclusion: Save Smart, Live Well

Finding ways to save money doesn’t mean giving up what you love. With a little intelligence and planning, it is possible to save thousands of rupees every year and still have meaningful experiences. Use your best judgment, choose a couple of ideas from this list, and build from there. You’ll be glad you did – along with your wallet and future self.

Which of these money-saving ideas will you try first? Let us know your thoughts, or check our site for more money-saving ideas!