Saving more every month is a commitment that can change your economic future, whether you’re a young professional, householder or housewife in India. The cost of living is increasing dramatically—imagine ₹100 for a cup of coffee or ₹2,000 for dinner for your family—so it’s more important than ever to identify opportunities for saving more every month. In this post, I’ve outlined 7 effective, practical ways to save more every month that fits the Indian context—with amounts in rupees. They are straightforward, actionable tips with a focus on making them work for you, without complications, because building wealth does not need to be stressful.

Table of Contents

Why Saving More Every Month Matters in India

In India, inflation is approximately 5–7% annually (source: RBI), which means money is worthless at some point in time. Every month that you save more money, is a hedge against inflation and increasing costs, builds an emergency fund or safety net for financial surprises, and assists in achieving financial goals such as purchasing a home or education. Regardless if you earn ₹20,000 a month or ₹1,00,000 a month, the following strategies will help you save more every month without losing your lifestyle.

Let’s get to it with the 7 proven ways to save more every month in India.

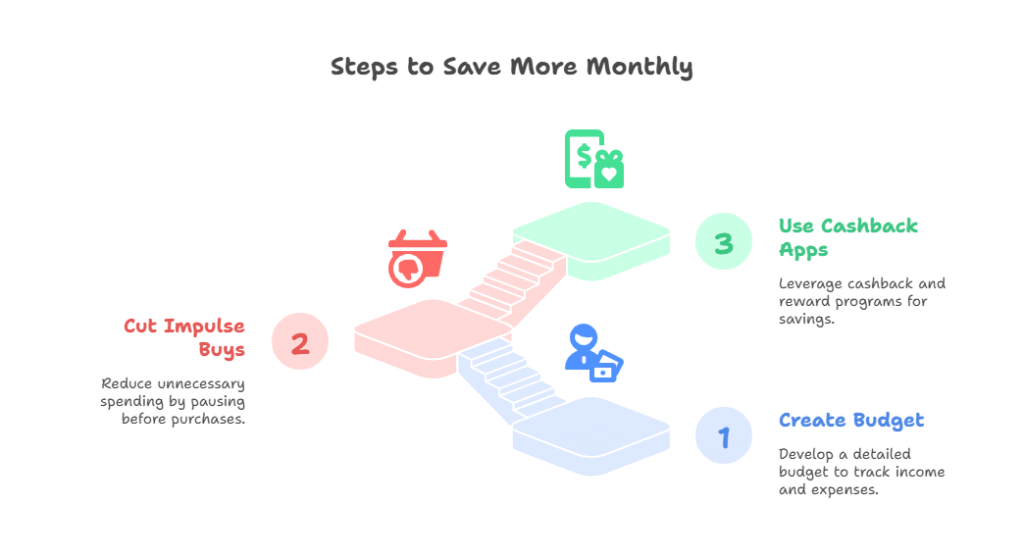

1. Create a Realistic Monthly Budget

To save more every month do this: First create a budget. A budget helps you keep track of what you earn, and what you spend. A budget also helps you identify unnecessary spending, allowing you to allocate that money to savings.

How to create a budget:

- Indicate your monthly income (e.g., ₹30,000 salary)

- Track necessary expenses (e.g., rent ₹8,000, groceries ₹5,000, bills ₹3,000)

- Before you ask if it is reasonable to have about 20% of your income (e.g., ₹6,000) allocated to savings and then to spend on non-essentials, set aside your savings anyway.

- For Housewives – You can keep a record of general household expenses with a notebook (or an app like Moneycontrol).

- For Single Young Adults – You can have a budget on non-essential expenses like dining out and subscriptions.

Pro Tip – Consider using the 50/30/20 guideline to help save more every month. To save 20% if you split your income as follows: 50% of your income for needs, 30% for wants and the remaining 20% goes to savings!

Check out – How To Budget Your Money.

2. Cut Down on Impulse Purchases

We often don’t think about it, but small purchases, like a ₹500 t-shirt on Amazon or a ₹200 snack at a mall, add up quickly. If you’re aiming to save more on a monthly basis, should you plan for impulse buys or pause before you purchase and ask yourself “Do I really need this?”.

Helpful tips:

- Wait 24 hours before you buy any discretionary purchase.

- Unsubscribe from marketing emails by Flipkart or Myntra.

- Set a monthly “fun budget”, e.g., ₹1,000 for impulse purchases.

- For Housewives: shop with a grocery list and avoid putting extras in your cart when you’re shopping at D-Mart.

- For Young Adult: deleting shopping apps on your phone will reduce your impulse clicking.

3. Use Cashback and Reward Apps

Cashback apps and reward programs are a great way to save more money every month in India. Cashback apps, such as CashKaro or Paytm, can offer cashback on everyday shopping, from groceries to mobile recharges.

How to use them:

- Get ₹50–₹200 in cashback for online shopping via CashKaro.

- Earn credit card rewards points to pay your bills or for petrol (for potential savings of ₹500−₹1000/month).

- Join rewards programs with stores like Big Bazaar for discounts.

- If you are a housewife, your entire shopping can come from cashback apps by how it links through your shopping at Amazon or Grofers.

- For the Young Adults: You can use your rewards points to redeem online serials to be streamed on Netflix or an OTT subscription.

Pro Tip: Instead of spending your cashback from cashback apps, transfer the money into your savings account to try to save more money every month.

4. Cook at Home and Meal Prep

Eating out or ordering from Zomato can cost ₹300–₹1,000 per meal. Cooking at home is a proven way to save more every month, especially for Indian households where homemade meals are both affordable and healthy.

- Money-Saving Ideas:

- Buy groceries in bulk from local markets (save ₹1,000–₹2,000/month).

- Meal prep weekly to avoid last-minute food orders.

- Cook simple dishes like dal-rice or khichdi (costs ₹50–₹100 per meal).

- For Housewives: Plan a weekly menu to streamline grocery shopping.

- For Young Adults: Batch-cook on weekends to save time and money.

5. Switch to Cost-Effective Utilities

Public utility bills such as electricity, internet and mobile plans can significantly impact your spending plan. Finding economical options can allow you to save more money each month.

Actionable tips:

- Use LED bulbs to reduce your electricity bills (saves you ₹200-₹500 a month).

- Change your mobile plan to prepaid, i.e., you’re paying ₹299/month with Jio rather than ₹500 for a post paid plan

- Compare providers for your internet. There will definitely be more affordable Internet plans, namely, Airtel which has a plan for ₹499.

- For Housewives: Unplug appliances when not used to cut your electricity costs.

- For Young Adults: Share your Wi-Fi with your roommates, that will cut costs.

Pro Tip: Check your bills every month so you are on top of overcharging and are not paying for things you are not using.

6. Start a Side Hustle for Extra Income

Boosting your income is a powerful way to save more every month. In India, side hustles like freelancing or selling homemade goods can add ₹5,000–₹20,000 to your monthly savings.

- Side Hustle Ideas:

- Freelance on Upwork for writing or design (earn ₹10,000–₹30,000/month).

- Sell homemade snacks or crafts on Instagram (₹2,000–₹10,000/month).

- Offer online tutoring via Vedantu (₹500–₹1,500/hour).

- For Housewives: Start a small catering service for local events.

- For Young Adults: Create digital products like budget templates (sell for ₹100–₹500 each).

Check out – Side Hustles in India to Make Extra Income to save more money.

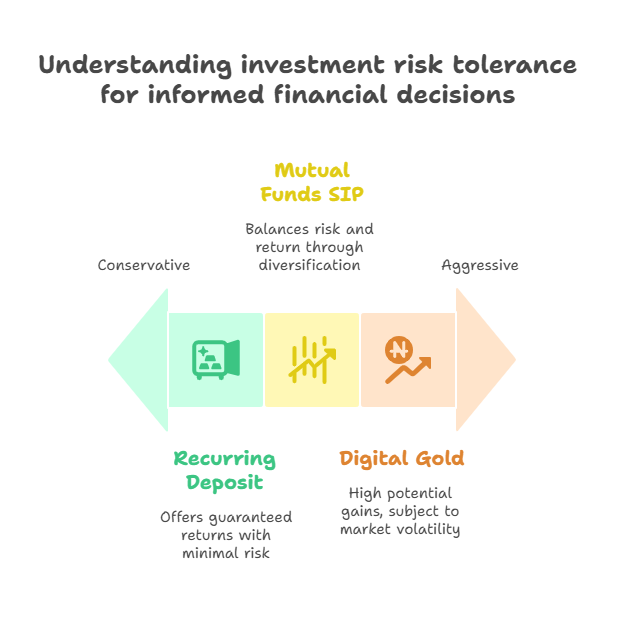

7. Invest Small Amounts for Future Gains

You save more each month to have money isn’t just about saving costs either. Growth of your money makes it more worthwhile. So you could do with your savings making more money for you via small investments.

Options for Investment:

- Start a Systematic Investment Plan (SIP) in mutual funds using Groww (minimum ₹500/month).

- Open a recurring deposit (RD) with banks (SBI has RD starting at ₹1,000/month at 6% interest) for savings purposes.

- Digitally buy gold through Paytm (minimum ₹100).

- For housewives: Investing in gold schemes would be an avenue of potential wealth and a shelter for the future.

- For young adults: Try equity mutual funds for returns over 5 years; we typically have higher returns here.

Pro tip: Reinvest dividends or interest to compound your savings, more options could be provided too.

Common Mistakes to Avoid When Trying to Save More Every Month

- Spending First: Always save before spending, not after.

- Ignoring Small Savings: ₹50 daily adds up to ₹1,500/month.

- Not Tracking Expenses: Use apps like Walnut to monitor spending.

- Overlooking Fees: Avoid high-fee bank accounts or investment plans.

Also read – Start Saving with Just ₹100 a Day.

Take Control of Your Finances Today

Whether you earn ₹20,000 a month or manage a household, you can save more every month. You may need to take note how you are spending your money to begin with a budget, cut down on impulse purchases, or simply get you started using cashback style money saving apps, cook at home, optimize your utilities, earn additional income and invest small amounts. These are the 7 fundamentals to saving every month and can be learned to add each method to your financial security plan, one rupee at a time. Start today by budgeting, or downloading a cashback app and grow your savings!

Call to action – Share your favourite saving tips in the comment.

3 thoughts on “Smart Money Moves: 7 Proven Ways to Save More Every Month”