Building wealth on a ₹30,000 monthly salary in India may seem daunting, but with the right strategies, it’s entirely possible. By making smart financial choices, cutting unnecessary expenses, and investing wisely, you can grow your savings and secure your future. This article shares 9 expert-approved ways to build wealth, tailored for Indian salaried individuals earning ₹30,000 per month. With practical tips and amounts in rupees, these hacks will help you maximize your income and achieve financial independence. Let’s dive in!

Table of Contents

Why Building Wealth Matters on a Modest Salary

You do not need to be a rich person to build wealth. Even earning ₹30,000 a month, with consistent small actions you will be able to grow your wealth over time. A report from the Economic Times in 2024 stated that Indians are often able to save because they are now spending more, but if you develop some disciplined habits that allow you to create a surplus for investments. This is nine strategies and tips are full of ways to help you build wealth while living a budgeted life.

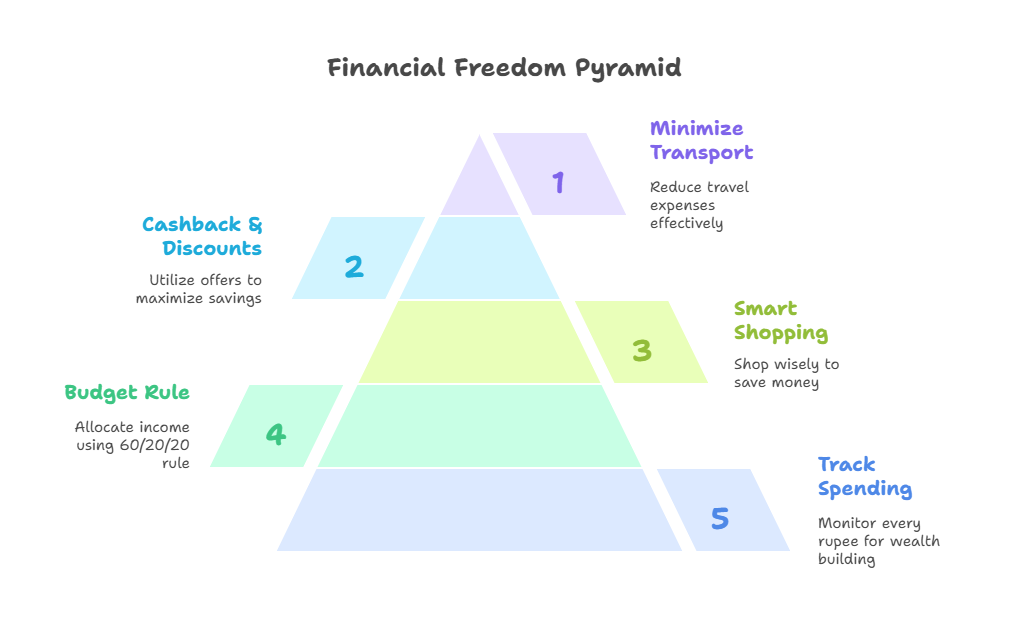

1. Track Every Rupee to Build Wealth

If you want to build wealth, you will need to understand how your money is spent. First, let’s take your ₹30,000 salary and track it with a free app like Money View or a simple spreadsheet. You will have consistent expenses at approximately ₹8,000-₹12,000 in rent, ₹4,000-₹6,000 in groceries, etc. Tracking these expenses can free up ₹1,000-₹2,000 a month to use towards your asset-building plan.

2. Adopt the 60/20/20 Budget Rule

A smart budget is essential to build wealth. Create a budget using the 60/20/20 rule – 60% (₹18,000) is for everything you need (rent, bills, groceries), 20% (₹6,000) should be put away for savings and investments, and the other 20% (₹6,000) should be for the things you want to do (dining out, entertainment, etc). If keeping rent low is a struggle, then you may need to spend less on your wants, which could mean paring down 500–₹1,000 on activities. Be diligent about sending ₹4,000–₹5,000 into a savings account with direct deposit – this will help you get on a good path to wealth building.

Savings- By budgeting you could save between ₹4,000 and ₹6,000 a month.

Learn 10 Smart Tricks to Save Money Fast and Stress-Free

3. Shop Smart to Free Up Funds

Groceries can consume ₹4,000–₹6,000 of your salary. To build wealth, shop at local markets or stores like Big Bazaar instead of upscale supermarkets. For example, a kg of potatoes costs ₹25 at a local vendor versus ₹40 at a mall. Buy staples like rice (₹50/kg) and lentils (₹90/kg) in bulk, and skip packaged snacks (₹50–₹100 per pack).

Savings: Smart shopping can save ₹500–₹1,500 monthly.

4. Leverage Cashback and Discounts

Digital payments can boost your wealth-building efforts. Apps like PhonePe and Amazon Pay offer 2–5% cashback on bills and shopping. Paying a ₹1,200 phone bill via these apps can earn ₹30–₹60 cashback. During sales on Myntra, use bank offers for 10–30% off on clothes or gadgets.

Savings: Cashback can save ₹300–₹1,000 monthly.

5. Minimize Transport Costs

Commuting usually costs ₹2,000–₹3,000 a month. To build wealth, try switching to public transport using buses (₹10–₹30 a trip), or metro trains (₹20–₹50 per trip in cities like Delhi). If you’re a vehicle owner, you can also carpool and split the fuel costs together (approximately ₹100/litre), and if possible, walking or cycling (to save ₹200–₹500) can also help your health, as well as wealth for those short trips!

Savings: Using public transport can lead to savings of ₹1,000–₹2,000 a month.

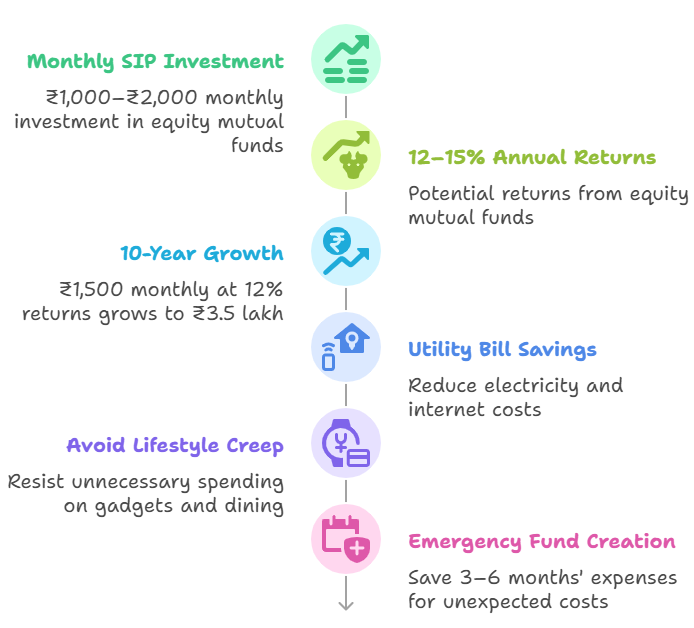

6. Invest in SIPs for Long-Term Wealth

To build wealth, you need to grow your savings. Open a Systematic Investment Plan (SIP). Start with ₹1,000–₹2,000 a month through Zerodha or ET Money. You can earn 12–15% annual returns through equity mutual funds. For example: You invest ₹1,500 a month, with 12% returns for 10 years, you would have over ₹3.5 lakh. You can increase your speed of saving as your income rises.

Impact: A consistent SIP strategy could compound your wealth in the long term.

Check out – 10 Daily Money Habits That Can Make You Rich

7. Slash Utility Bills

Utility bills, like electricity (₹1,500–₹2,500) and internet (₹500–₹800), can hinder wealth-building. Use LED bulbs (₹100–₹150 each) and 5-star-rated appliances to cut electricity costs by 20%. Limit AC usage to 2–3 hours at 24°C, and switch to prepaid mobile plans (₹200–₹300 monthly) to avoid overages.

Savings: These habits can save ₹400–₹1,000 monthly.

8. Resist Lifestyle Creep

Buying flashy gadgets (₹15,000–₹40,000) or frequent Restauration (₹800–₹1,500) can destroy your wealth building ambitions. Stick to affordable brands like Xiaomi for phones (₹10,000–₹15,000) and if you’re used to using Zomato, learn to cook yourself. Take a 48 hour wait period before spending your money.

Savings: Avoiding lifestyle inflation can save you around ₹2,000–₹4,000 in a month.

9. Create an Emergency Fund

An emergency fund protects your wealth from unplanned expenses like medical bills (₹5,000–₹15,000). Aim to keep 3–6 monthly expenses (₹30,000–₹60,000) in a high-interest savings account or liquid fund. To build your fund, save ₹1,000–₹2,000 a month from your ₹30,000 salary – avoid using an investment for your fund.

Impact: An emergency fund protects your wealth and can help you on your journey towards accumulating wealth.

Also Read – 7 Powerful Reasons to Build an Emergency Fund

Bonus Tip: Boost Your Income

If you’ve got a bit of extra income, it’s easier to build wealth. Learn high-demand skills such as graphic design or content writing through inexpensive courses on Skillshare or Udemy for ₹500 – ₹2,000. Freelancing can provide an additional ₹5,000 – ₹10,000 per month, to add to the amount you save and invest.

Impact: Extra income helps you build wealth faster.

Also read – Side Hustles to Make Extra Income in 2025

Conclusion: Build Wealth with Discipline

These 9 expert-approved ideas to build wealth on a salary of ₹30,000 prove it’s possible! By tracking your spending, getting a budget, and investing regularly, you can save ₹5,000-₹10,000 a month and build your wealth. Pick one or two strategies to start, such as setting up an SIP or trimming transport costs, and then gain momentum.

If you’re looking for more financial tips, taking a beginner’s investing guide, or tips on budgeting, we have advice on everything! Start taking charge of your finances now and begin building wealth!

3 thoughts on “9 Expert-Approved Ways to Build Wealth on a ₹30K Salary”