Saving more money is one of the common goals for most Indians especially witnessing rising costs and not to mention the surprise or unpredictable expenses along the way. Whether you are saving for a dream holiday, a new tech gadget or emergency fund for unforeseen expenses – little changes in your everyday habits can result in a considerable amount of savings month after month.

In the following article, we’ll share 11 quick hacks to save more money each month the Indian way. These methods are practical and withheld in Rupees based on the Indian economy and way of life. The practical ways for saving, with money in Indian Rupee and how easy they are, are what we are sharing to enjoy saving and keeping more money in your pocket without missing out or feeling deprived.

Table of Contents

Why Saving More Money Matters in India

With inflation impacting everything from groceries to fuel, finding ways to save more money is crucial for financial stability. According to a 2024 report by the Reserve Bank of India, household savings rates in India have been declining due to increased spending on essentials. By adopting smart money-saving habits, you can stretch your income further and work toward your financial goals, whether it’s buying a home or securing your future.

Let’s dive into these 11 hacks to help you save more money every month!

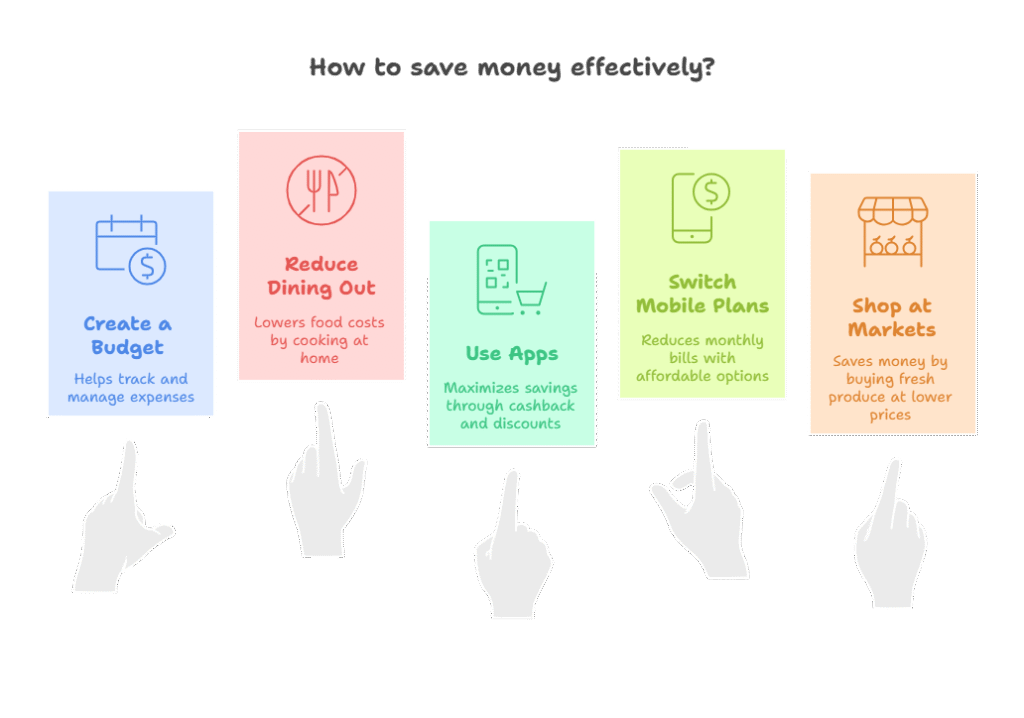

Hack 1: Create a Realistic Monthly Budget

To save more money, the first step is to keep track of income and expenses. Use a budgeting app like Moneycontrol, or something as simple as a notebook, to note down your income and expenses for the month. You then just need to set aside room for must-pay expenses – rent (between ₹10,000 and ₹20,000 in a metro city), grocery bill (a ₹5,000 to ₹8,000 bill for a family of 4), utilities (₹2,000 to ₹4,000),etc. Also although it sounds easier said than done, try to save 10%–20% of your income (for instance, I allocate ₹5,000 every month of my ₹50,000 salary) BEFORE any other spending (like takeout!).

Hack 2: Cut Down on Dining Out

Eating out or ordering food via apps like Zomato or Swiggy is convenient but expensive. A single meal for two at a decent restaurant costs ₹800–₹1,500, while frequent food deliveries can set you back ₹3,000–₹5,000 monthly. To save more money, cook at home and limit dining out to once or twice a month. Batch-cook meals on weekends to save time, and carry homemade lunches to work.

Savings: Cooking at home can save you ₹2,000–₹4,000 per month.

Also read – Beginner’s budgeting guide.

Hack 3: Use Cashback and Discount Apps

India’s digital payment ecosystem is booming with apps like Paytm and PhonePe offering cashback on bill payments, recharges and shopping. For instance, paying your electricity bill (₹2,000) through these apps can give you between ₹50–₹100 cashback. It’s like using an app like Myntra or Amazon India to purchase something when it’s on sale that day and receiving a 20%–50% discount on clothes and electronics. This will save more money for you.

Savings: Cashbacks and discounts can provide you with about ₹500–₹1,500 savings each month.

Hack 4: Switch to Affordable Mobile Plans

Mobile bills can silently drain your wallet and this will definitely not save more money for you. Many Indians pay ₹500–₹1,000 monthly for premium plans with unused data. Review your usage and switch to budget-friendly plans from providers like Jio or Airtel, which offer 1.5–2 GB daily data for ₹200–₹300 per month. Avoid unnecessary add-ons like premium subscriptions (e.g., Netflix via telecom plans).

Savings: Switching plans can save you ₹200–₹700 monthly.

Hack 5: Shop Smart at Local Markets

If you want to save more money on groceries, avoid expensive supermarkets and go to local vendors, or wholesale agents like D-Mart. Vegetables and staples, such as rice and dal, are priced 20-30% higher in supermarkets and will save you a good chunk of change. One kg of tomatoes can cost ₹40.00 at a market and ₹60 at the supermarket. Plan lists ahead of time to stay focused instead of buying groceries impulsively while you are shopping for something else. Stock up on non-perishables when they are discounted.

Estimated Savings: Smart shopping can save ₹500–₹1,000 each month.

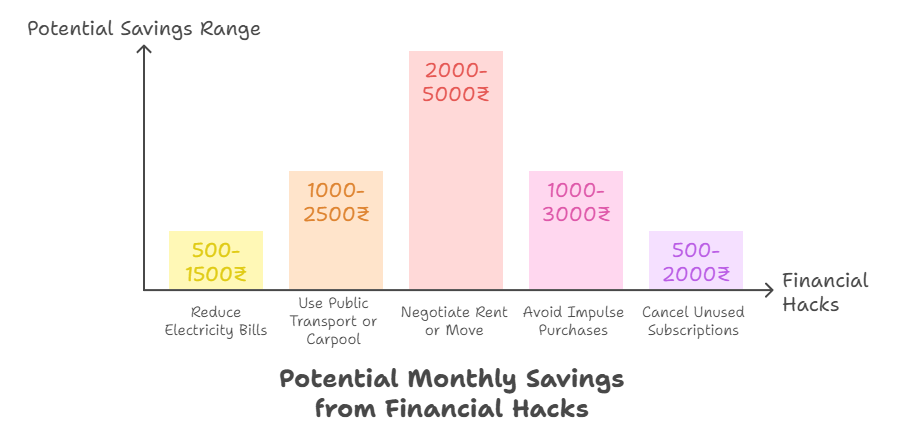

Hack 6: Reduce Electricity Bills

Electricity bills in India can range from ₹2,000–₹5,000 for a small household, especially in summer with AC usage. To save more money, switch to energy-efficient appliances (5-star rated) and use LED bulbs, which cost ₹100–₹200 but last longer. Turn off appliances when not in use, and limit AC usage to 3–4 hours daily at 24°C. Use fans or coolers for smaller rooms.

Savings: These changes can cut your bill by ₹500–₹1,500 monthly.

Hack 7: Use Public Transport or Carpool

Like many countries, fuel prices in India are about ₹100–₹110 per litre, so commuting to work is naturally expensive. If you spend about ₹3,000 a month on petrol to use your bike or car, you might want to consider the advantages of using public transport. In some cities, like Delhi, you can use metro buses for ₹20, train stations for ₹30 – ₹90 and auto-rickshaws for ₹30. Carpooling with some colleagues is a better option than petroleum cars and saves a lot of fuel.

Potential savings: One person might save you between ₹1,000-₹2000, transportation can be between ₹1,000-₹2500 monthly.

Hack 8: Negotiate Rent or Move to a Cheaper Area

Rent is a major expense, often ₹10,000–₹25,000 in cities like Mumbai or Bangalore. To save more money, negotiate with your landlord for a 5–10% discount, especially if you’re a long-term tenant. Alternatively, consider moving to a slightly farther but cheaper area. For example, moving from Andheri to Borivali in Mumbai can save more money on rent.

Savings: Rent adjustments can save ₹2,000–₹5,000 monthly.

Hack 9: Avoid Impulse Purchases

Impulse buys, like trendy gadgets or clothes, can derail your savings. Before buying anything over ₹1,000, wait 48 hours to decide if it’s necessary. Unsubscribe from marketing emails and avoid browsing e-commerce apps during sales. Create a “wishlist” and prioritize items only when you have extra funds.

Savings: Avoiding impulse buys can save ₹1,000–₹3,000 monthly.

Hack 10: Invest in a SIP for Small Savings

Buying more money doesn’t mean just to leave it sitting in cash. You can start a SIP, or Systematic Investment Plan, with a minimum of ₹500 per month, using platforms like Groww and Zerodha. Mutual fund SIPs have an average return of between 10–15% annually over time, and provide an excellent use of savings. If you have ₹2,000 a month in SIPs, it can grow to ₹3.5 lakh in ten years with twelve percent returns.

Savings: SIPs provide the most bang for your buck, with little effort you can save more money.

Also read – Start Saving with Just ₹100

Hack 11: Cancel Unused Subscriptions

Streaming services like Netflix (₹199–₹649/month), Amazon Prime (₹129/month), and gym memberships (₹1,000–₹3,000/month) add up quickly. Audit your subscriptions and cancel those you rarely use. Share family plans with friends or family to split costs (e.g., a ₹649 Netflix plan shared by four people costs ₹162 each).

Savings: Cancelling or sharing subscriptions can save ₹500–₹2,000 monthly.

Bonus Tip: Track Your Savings Progress

To maintain motivation, actively track your savings each month in the form of a spreadsheet or an app. For instance, if you save ₹500 on groceries, ₹1,000 on transport, and ₹1,500 on electricity, then you have just added ₹3,000 to your bank! Once you have tracked the savings, add them up and celebrate your small outcomes by rewarding yourself in some small way, like spending ₹100 on coffee.

Conclusion: Start Saving More Money Today

These 11 quick hacks to save more money every month in India are simple yet effective. By budgeting wisely, cutting unnecessary expenses, and making smart choices, you can save ₹5,000–₹15,000 monthly without sacrificing your lifestyle. Start with one or two hacks and gradually adopt more to see your savings grow.

1 thought on “11 Quick Hacks to Save More Money Every Month in India”