If you’ve ever felt saving money is too difficult or impossible, you’re not alone. Especially when responsibilities like household expenses, children’s schooling, or simply day-to-day survival take up most of your income, putting money aside feels tough. But what if I told you that you can learn how to start saving with just ₹100 a day? Yes, just ₹100! Whether you are in your 20s, running a household, or managing a family, this small change can set the foundation for big financial success. Let’s explore how.

Table of Contents

Why Saving ₹100 a Day Matters

Saving ₹100 a day might seem like a small effort, but it adds up. In just one month, that’s ₹3,000. In a year, you’ll have ₹36,500 — not counting any interest you might earn if you invest it smartly!

Small savings lead to big dreams: whether it’s funding your emergency fund, buying a new appliance, planning a trip, or investing for your future, starting small builds the habit and confidence you need.

Step 1: Set Clear Savings Goals

Before you begin, know why you’re saving. Goals give your money a purpose.

- Emergency Fund: Aim for at least ₹50,000 initially.

- Short-Term Goals: New mobile phone, festive shopping budget.

- Long-Term Goals: Retirement savings, child’s education.

Knowing your “why” keeps you motivated when temptations arise.

✅ Read our post on Top Financial Goals to Achieve Before 30

Step 2: Create a Separate Savings Account

Use budgeting apps like Walnut, MoneyView, or simply maintain a notebook. See where your ₹100 can come from — maybe by:

- Skipping one snack at the market.

- Taking public transport instead of booking a cab.

- Preparing homemade lunch instead of eating out.

Over a month, these small sacrifices build a stronger financial future.

Step 4: Make it a Family Habit

If you’re a householder or a housewife, involve your family:

- Encourage kids to save coins.

- Challenge your spouse to save on groceries using cashback offers.

- Set family saving targets and celebrate when you hit them.

Making saving a team activity is powerful!

Step 5: Invest Your ₹100 a Day Wisely

Saving alone isn’t enough. Invest your savings!

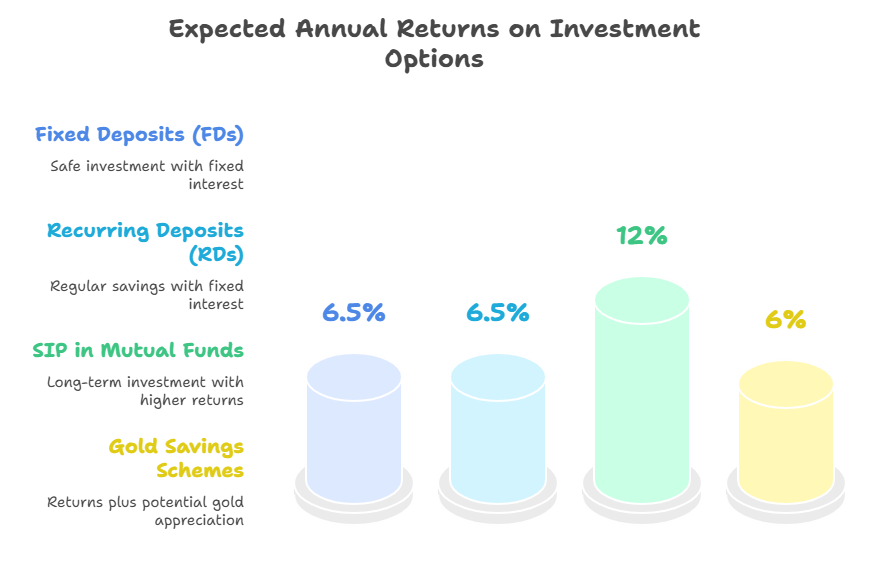

Options for Indian savers:

Even ₹3,000/month in an equity mutual fund via SIP can grow significantly over time thanks to compounding.

Step 6: Boost Your Income

To start saving with just ₹100 a day more comfortably:

- Sell unused items online (on OLX, Quikr).

- Take a freelance project if you have skills.

- Start a small home-based business like tiffin services, tuition classes, or handmade crafts.

Extra income = extra savings without sacrificing essentials!

Step 7: Cut Unnecessary Expenses

To start saving with Just ₹100 a Day becomes easier when you trim unnecessary spending:

- Limit online shopping.

- Avoid ordering food online frequently.

- Cut expensive subscriptions (hello, 5 OTT platforms?).

Remember: Every ₹100 saved is ₹100 closer to your dreams.

Real Life Example

Anjali, a 28-year-old housewife from Pune, decided to start saving with just ₹100 a day after attending a financial literacy workshop. She created a separate savings account, cooked meals at home, cut down impulsive shopping, and deposited ₹3,000 every month.

After one year, she had ₹36,000 saved. She invested it in a short-term mutual fund and now feels more financially secure, with plans to grow it even more.

If Anjali can do it, so can you!

Motivation to Keep Going

- Track your progress monthly.

- Set visual savings goals (like a savings thermometer on your fridge!).

- Celebrate small milestones like saving ₹5,000, ₹10,000, etc.

Building momentum keeps you emotionally invested and financially focused.

Final Thoughts: How to Start Saving with Just ₹100 a Day

Starting small is better than not starting at all. When you start saving with just ₹100 a day, you not only grow your money, but also your discipline, confidence, and future possibilities.

You’ll look back a year later and thank yourself.

So, start today — your future self is cheering for you!