Managing your salary wisely is the cornerstone of financial freedom, especially for young adults in their 20s, householders, and housewives in India. Whether you’re earning ₹30,000 or ₹1,00,000 a month, knowing how to allocate your income effectively can help you achieve your dreams—be it buying a home, funding your child’s education, or planning a dream vacation. In this guide, we’ll explore 9 smart ways to manage your salary like a pro, tailored for Indian households, with practical tips to make your money work harder for you.

Table of Contents

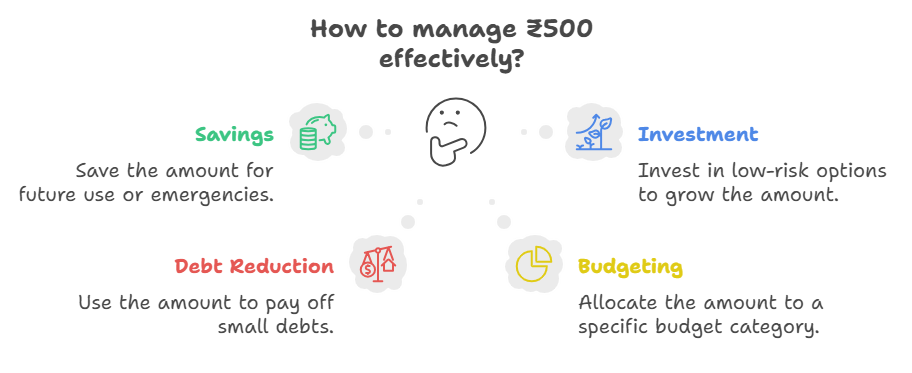

Why Managing Your Salary Matters

In your twenties, you’re probably dealing with student loans, rent, and/or family obligations. Householders and housewives, however, usually manage to survive on a limited budget to maintain healthy family life. Given today’s rising costs: remember when a litre of milk was ₹15 and a kilo of tomatoes was ₹100? With prices like that, knowing how to manage a salary so you can save for later, deal with emergencies, and still spend on luxuries like a movie night at ₹500, is vital.

Let’s dive into the 9 smart ways to manage your salary like a pro that are simple, actionable, and perfect for Indian budgets.

1. Follow the 50/30/20 Rule for Budgeting

The 50/30/20 rule is a golden framework for Smart Ways to Manage Your Salary. Here’s how it works:

- 50% for Needs: Allocate half your income to essentials like rent (₹10,000 for a 1BHK in a Tier-2 city), groceries (₹5,000 for a family of four), and utilities (₹2,000).

- 30% for Wants: Spend on non-essentials like dining out (₹1,000 for a family pizza night), subscriptions (₹299 for Netflix), or new clothes.

- 20% for Savings/Debt: Save or invest at least 20% (e.g., ₹6,000 on a ₹30,000 salary) in a fixed deposit, mutual fund, or to clear loans.

For housewives managing household budgets, track expenses using a notebook or apps like Moneycontrol to ensure you stay within these limits.

Pro Tip: If 50% isn’t enough for needs, adjust to 60/20/20 temporarily, but aim to reduce expenses over time.

2. Build an Emergency Fund

The next smart ways to manage your salary is Life can be unpredictable. You can have an emergency medical situation (₹50,000 hospital bill) or you can be laid off from your job and find you are in a financial bind. An emergency fund can act as a safety net for you. Ideally, your goal should be to save from 3 to 6 months of living expenses (if you have ₹20,000 per month budget, then save ₹60,000-₹1,20,000).

Start small – save ₹500 to -₹1,000 a month at a high interest savings account or a liquid mutual fund. SBI’s savings account has good interest rates on small savings.

For the Housewives – create a separate “emergency jar” to save cash to cover the small unexpected costs from your monthly budgets such as repairs to appliances.

3. Prioritize High-Interest Debt Repayment

If you have a personal loan at 12%, or a credit card with monthly interest at 36% (with ₹10,000 in minimum payments) pay it off first. High-interest debt steals your paycheck each pay cycle, making it difficult to save, plan for or spend money on fun things.

Use the most common debt repayment method, called the avalanche method, to pay off your debts. To use the avalanche method, pay off the highest interest debt first and make minimum payments on the others. For example, if you owe ₹50,000 on a credit card, by allocating ₹5,000 monthly, you will pay it off in 10 months (savings thousands on interest).

For Young Adults: Do not fall into lifestyle inflation – don’t upgrade to a new ₹20,000 smartphone on EMI just because you got a raise.

Also Read : How to Start Saving with Just ₹100 a Day

4. Invest Early for Long-Term Wealth

Investing is how you build up your wealth. In your 20s, your biggest investment is time. If you save ₹5,000 per month into a mutual fund at a 12% return, you will reach ₹1 crore in 25 years, thanks to compounding.

Mutual Funds: You can start a Systematic Investment Plan (SIP) in a mutual fund for as little as ₹500 on platforms like Groww.

Public Provident Fund (PPF): PPF is safe and tax-free. PPF is one of the best investments for housewives or those who want to invest, but are risk averse. In PPF, you can invest ₹1,50,000 each year and receive 7.1% returns.

Stocks: You can also invest in stocks, if you are someone who is comfortable with risk. You can buy blue-chip stocks, such as Reliance or Infosys, through Zerodha. This is very smart ways to manage your salary.

Pro Tip: Don’t invest all of your money in one investment, and make sure to diversify. Consult a SEBI-registered investment advisor, who can give you advice for your personal situation.

5. Automate Your Savings

Out of sight, out of mind. Automate your savings to prevent you from spending what you intended to save. You should set up auto-debits for:

₹2,000 monthly SIP to a mutual fund.

₹1,000 to your emergency fund savings account.

₹5,000 for a recurring deposit (RD) to save for short-term goals, like a ₹50,000 expenditure to celebrate Diwali.

You can use apps for tracking auto-saved amounts and adjusting budgets, that’s how housewives use these to help keep organized. There are plenty of apps, such as Wallet by BudgetBakers.

6. Cut Unnecessary Expenses

The next smart ways to manage your salary is to analyse your expenses to discover any leaks. With that ₹150 pint of coffee every day, you could spend ₹4,500 a month—enough for a weekend trip.

Common areas we all can cut:

Subscriptions: Cancel your unused OTT, so you pay ₹299 a month for Amazon Prime.

Unplanned Purchases: That’s the problem with online shopping – those ₹500 random gimmicks will sneak up on you during those blowout sales.

Takeaways: If you can limit yourself or your family to visiting restaurants on Friday or Saturday night (save around ₹2,000/month).

If you are a housewife, your monthly goal should be to bargain at local markets and use BigBasket for your grocery requirements: Even bulk buying should save you around ₹500-₹1,000 a month.

Also Read : How to Budget Your Money

7. Plan for Big Goals

Whether it’s a ₹5,00,000 down payment for a home or ₹2,00,000 for your child’s education, big goals need planning. Break them into smaller milestones is the smart ways to manage your salary:

- Short-Term (1-3 years): Save ₹1,00,000 for a car by setting aside ₹3,000 monthly in an RD.

- Long-Term (5+ years): Invest ₹10,000 monthly in equity mutual funds for a ₹10,00,000 goal in 10 years.

Use a goal-based investing calculator on ET Money to estimate monthly savings.

8. Protect Your Finances with Insurance

Insurance is necessary, meaning there are no alternatives. A ₹1 crore term insurance plan will cost your 25 year-old child ₹500-₹1,000 a month and guarantee your family. Health insurance (₹5,00,000 coverage) costs ₹10,000-₹15,000 per year to save lakhs of rupees in the event of any medical emergency.

For Householders: Check Policybazaar for a family floater plan to protect your entire family under one policy.

9. Upskill to Boost Your Income

The better way to manage a salary is to increase that salary! In your 20’s, invest in skills to maximize employability:

Online Courses: understand digital marketing or coding on Coursera (i.e. ₹5000-₹10,000)

Side Hustles: Freelancing on Upwork or selling homemade goods (i.e. candles ₹500)

Housewives can start small businesses, and further supplement household income (i.e. pickles, homemade ₹200).

Bonus Tips for Indian Households

- Tax Planning: Save up to ₹1,50,000 annually under Section 80C with ELSS funds or PPF.

- Festive Budgeting: Plan for Diwali or Eid expenses (₹10,000-₹20,000) months in advance.

- Cashback Apps: Use Cred or PhonePe for rewards on bill payments.

Conclusion

Like a pro, smart ways to manage your salary is not about making lakhs, it’s about making your rupee dollars work for YOU. You can create a better future for yourself and enjoy life in the present by budgeting intelligently, saving consistently, and investing wisely. Pick one or two of these 9 smart ways to manage your salary like a pro and incorporate them in no particular order as you see fit. You will thank your wallet, and your future self will be grateful.