Credit cards can be an effective financial tool when managed correctly but when used incorrectly, they can quickly become a financial burden. With the rising number of credit card users in India, many people find themselves engaging in practices, without realising that can impact their credit score. If your credit score is below 650, you will struggle to secure loans, you will pay more on loans with higher interest rates, and your job opportunities may even be impacted.

Here are nine credit card habits that can hurt your credit score and practical examples you can follow to avoid these habits. By being aware of these mistakes and avoiding them, you should be able to keep your credit score and finances in check.

Table of Contents

What Is a Credit Score and Why Does It Matter?

Before getting into the habits I want to help you avoid, it is important to understand what exactly a credit score is. In India, a credit score is a three-digit score (usually between 300 and 900) calculated by credit bureaus (CIBIL, Experian, Equifax). Your credit score indicates your creditworthiness based on your financial behaviour, particularly how you manage loans and credit cards. Scores above 750 are considered good, while anything below 600 can make it difficult to get approved for credit.

Your credit card usage is a contributing factor in determining this score. Getting trapped in credit card usage can lead to missed payments, increased debt, or other signals that an underwriter or lender will look at to determine your creditworthiness. Now let’s look at the nine habits you should avoid.

1. Missing Credit Card Payments

Missing payments is among the worst credit card behaviors. Once you miss a due date for any amount due, including the minimum required amount, it is reported to the credit bureaus, and your score is typically negatively impacted. Credit card interest rates in India can be as much as 36–48% a year, and late payments typically incur fees as well (typically ₹500–₹1,000 depending on the bank). These are only a few reasons why the fees can pile up and create barriers to get rid your balance.

How to Avoid This Trap:

- Set up auto payments for at least the minimum due amount.

- Set up reminders or calendar alerts for the due dates.

- Discuss your situation with your bank to negotiate a repayment plan if you need help.

2. Maxing Out Your Credit Card

Completely using your credit limit, also known as maxing out your card, is something that credit bureaus will consider a red flag. You should keep your utilization ratio – the amount of your credit you are actually using, with the available credit – ideally under 30%. If you have a limit of ₹1,00,000, your balance should be below ₹30,000. Maxing out your credit means you are likely using credit too much, which can reduce your score.

How to Avoid This Trap:

- Watch your spending and keep your balance down.

- If you are often close to your credit limit, request an increase.

- Consider using multiple credit cards and spread your spending over a few cards, but don’t open too many accounts at a time.

3. Only Paying the Minimum Amount Du

While just paying the minimum amount due may seems easy, it’s an expensive habit to have. The minimum payment – often 5% of your outstanding balance – typically only covers interest charges and leaves the principal amount addressed. This creates a debt spiral with growing interest over months and years. For example, a ₹50,000 balance at 40% annual interest would take you over ten years to clear if you just pay the minimum, costing you thousands of rupees in interest alone.

How to Avoid This Situation:

- Try to pay your entire balance each month.

- If that’s not possible, pay more than the minimum so that you pay down your principal a little faster.

- Pay down high-interest cards first to save money.

Also Read : Ways to Build Wealth on a ₹30K Salary.

4. Applying for Too Many Credit Cards

Whenever you engage in the process of applying for a credit card, the bank will access your credit report and perform what’s called a “hard inquiry” that will temporarily, on average, lower your score by 5–10 points. When you apply for multiple cards in a short time frame, you send a signal to the lenders that you are a financial risk. In India, where banks market aggressively to attract customers with credit cards, it is easy to apply for every card offer that seems appealing, but this strategy can backfire on you.

Avoiding This Trap:

- Research cards and apply to ones that fulfill your needs rather than just the cards with appealing rewards.

- Space out card applications. Don’t apply for multiple cards at once, give a good time period, like six months.

- Check your credit score regularly so you understand the state of your credit before you decide to make applications.

5. Ignoring Credit Card Statements

In many parts of India, many people will fail to review their credit card statements each month because there is a belief that any statement transaction must have a valid agreement. While this might feel true, you might mistakenly ignore erroneous transactions, fraud or even undisclosed fees like annual fees between ₹500–₹5,000 that some banks charge cardholders. If you simply just let those things go, it could accumulate, wreak some havoc on your finances, and destroy your credit impact.

So, how do you avoid this trap?

● At least, review your statement once a month for errors or unauthorized charges.

● Report any fees or mistakes on your plan or transaction immediately to your bank.

● Use the mobile banking app on your smartphone to have as close to a live transaction affect.

6. Using Credit Cards for Cash Advances

Taking a cash advance on your credit card is one of the most expensive mistakes you can make. In India, cash advances always carry hefty fees 2.5-3.5% of the cash advance (often with a minimum of ₹300-₹500) and interest rates that start accruing right away (often 40 percent or more annually) with no interest-free period after you make the advance. These advances can also send a signal to credit bureaus that you are experiencing financial distress.

The way to avoid this trap:

- Use cash advances only in an emergency.

- Consider other options like a personal loan as this will be a lower rate of interest than your credit card.

- Pay off cash advances as soon as you can so that you reduce your interest.

7. Not Understanding Credit Card Terms

A large number of credit cardholders in India do not appreciate or understand the terms and conditions, including interest rates, rewards point redemption, annual fees, etc. For example, some cards advertise “free” rewards – however, if you do not pay up to X amount of spending, you will need to pay an annual fee they will state (anywhere from ₹1,000-₹10,000). If you do not fully understand the terms of these rewards, you could potentially be paying unexpected costs, or loss in opportunity for optimal card usage.

How to Avoid This Trap:

- Read the fine print before signing up for the card.

- Ask your bank to clarify terms such as interest free periods or information on reward redemption.

- Use trusted websites like BankBazaar to be sure the comparisons are transparent and similar.

Check Out: Tricks to Cut Expenses Without Feeling Broke.

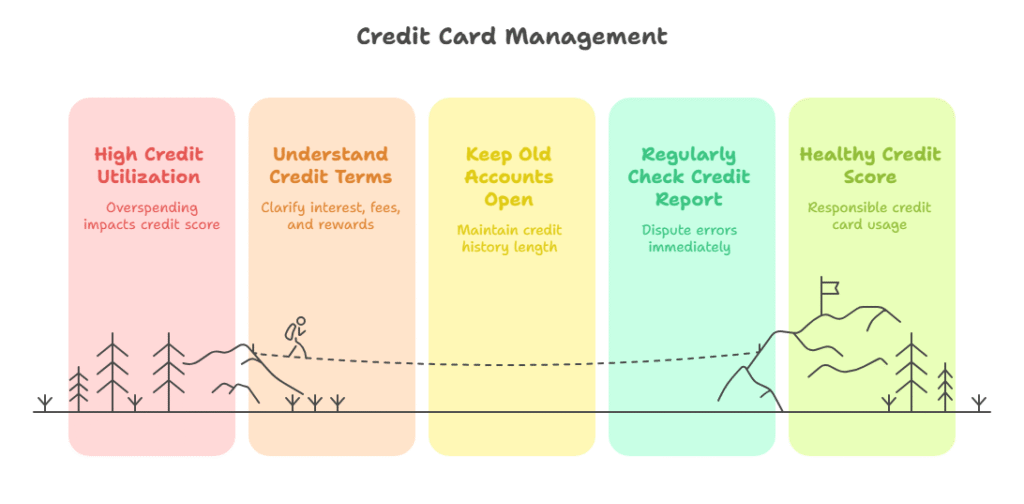

8. Closing Old Credit Card Accounts

Closing an account you no longer use might feel like a good way to reduce friction in your financial life. However, closing a credit card create two problems for your credit score: one related to your total utilization score; the other related to how long you have credit history.

All credit scoring models factor in “credit history length. If you have an older account, it will improve your credit score for as long as that account is kept open. You are also reducing your total available limit when you close an account, and this worsens your utilization score. For example, if you use your credit cards up to ₹50,000 and close a credit card with a limit of ₹50,000, you are using 100% of your available credit limit.

How to Avoid the Credit Score Closing Trap:

- Leave old accounts open, even if you never use them anymore.

- Use old accounts from time to time, for small purchases.

- If an old account has annual fees, contact the bank to see if you can negotiate fees or switch to a no-fee account.

9. Ignoring Your Credit Report

Your credit report is a record of all your credit history including all of your activity for all your credit cards. If there are mistakes in your report, such as wrong status of your payments or an unknown account, that can negatively affect your score unfairly. The Credit bureaus in India, for example CIBIL, allow you to check your credit report for free once a year. If you don’t check this report, you might miss errors that could affect your creditworthiness.

How to Avoid This Trap:

- Check your credit report once a year at a minimum on CIBIL’s website.

- If you see errors, dispute them with the credit bureau right away.

- Keep track of your score to monitor your progress or issues on a regular basis.

Tips to Use Credit Cards Wisely in India

Now that you know the traps, here are some general tips to manage your credit cards effectively:

- Budget Wisely: Create a monthly budget to ensure you don’t overspend. Tools like our budgeting guide can help.

- Leverage Rewards: Choose cards that align with your spending habits, like travel or fuel cards, and redeem points regularly.

- Stay Disciplined: Treat your credit card like a debit card—only spend what you can pay off in full.

- Build an Emergency Fund: Save at least ₹50,000–₹1,00,000 to avoid relying on credit cards during emergencies. Check our emergency fund tips for more.

Conclusion

Credit cards are a double-edged sword. If you use credit cards the right way, you could be rewarded, boost your credit score, and have the added flexibility of financing your purchase over time. However, if you fall into these nine dangerous habits – forgetting payments, maxing out your cards, only paying the minimum payments, applying for too many credit cards, not remembering to check your statements, taking cash advances, misunderstanding terms and conditions, closing old credit accounts, and ignoring your credit report – you could run into some serious trouble with your credit score and finances. With the growth of credit card penetration in India, it is more imperative than ever to stay disciplined regarding credit habits.

If you take the steps towards minimizing these credit card traps, you can maintain a healthy credit score and enjoy all of the potential benefits of using credit cards responsibly. Take the steps to get started today by reviewing your credit card statements, checking your credit report, or making a budget to track your finances.

1 thought on “Credit Card Traps: 9 Dangerous Habits That Kill Your Credit Score”