Managing money in today’s fast-paced world can feel like juggling flaming torches while riding a unicycle. With rising costs, unexpected expenses, and the constant temptation to splurge on that new smartphone or a weekend getaway, sticking to a budget is no easy feat. But don’t worry! These budgeting tricks are designed to help every Indian take control of their finances, save more, and achieve their financial goals—whether it’s buying a dream home, funding a child’s education, or planning for retirement. In this article, we’ll explore seven fool proof budgeting tricks that are practical, easy to implement, and tailored to the Indian context, with all amounts in Indian Rupees (₹).

Table of Contents

Why Budgeting Tricks Are a Game-Changer for Indians

In India, with its stark differences in cost of living from Mumbai to a small town, being in control of budgeting tricks is crucial to financial planning. Factors like rising vegetable prices and high EMIs are challenges many are facing on a daily basis. And in a 2024 survey from the Reserve Bank of India, over 60% of Indian households routinely cannot save money due to irregular expense amounts. The budgeting tricks below can work for you, at any income level.

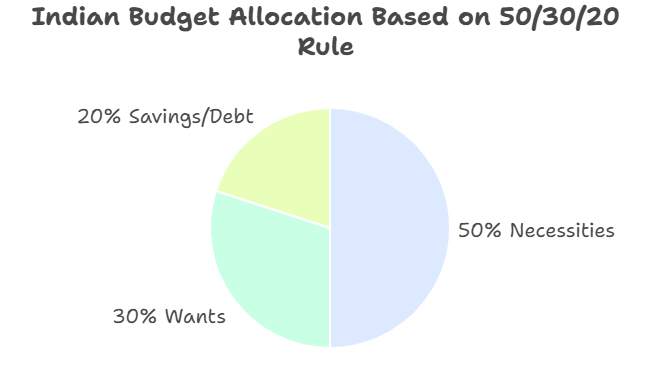

Trick 1: Follow the 50/30/20 Rule with an Indian Twist

The 50/30/20 rule is a well-known principle of budgeting tricks, but let’s put an Indian spin on it. 50% of your net income should be spent on needs (rent, groceries, utilities), 30% on wants (eating out and entertainment) and 20% on savings or debt repayment. The following example assumes your net monthly income is Rs. 50,000.

Needs (Rs. 25,000): Rent (Rs. 12,000), Groceries (Rs. 8,000), Utilities (Rs. 3,000), Transportation (Rs. 2,000).

Wants (Rs. 15,000): Eating out, subscriptions, or shopping.

Savings/Debt (Rs. 10,000): Saving account, mutual funds, or repayment of loans.

Indian Spin: In India, budgets can be derailed by festivals (e.g., Diwali, wedding seasons) so, it’s best to budget and reserve at least a small “festival fund” in the requirement of your 20% savings (i.e. Rs. 2,000 monthly) to prevent you from dipping into your emergency savings for gifting.

Pro Tip: Track your expenditures with free apps like Moneycontrol to ensure you stay accountable to this budgeting tricks.

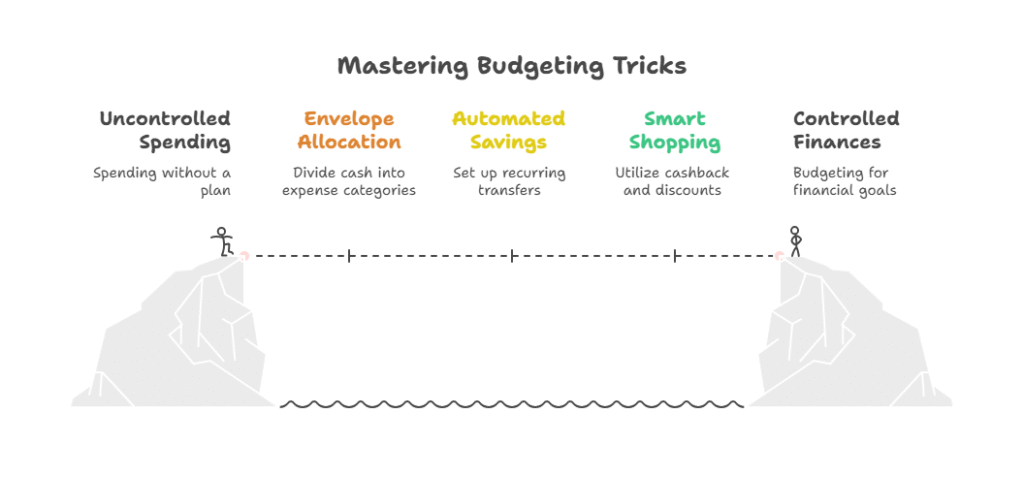

Trick 2: Use the Envelope System for Cash-Based Spending

The envelope system is one of the best tricks you can put to work in your budgeting tricks when you’re trying to take control of discretionary spending. Here’s the idea: after you have covered your fixed costs (rent, bills), you can then divide the money left for all the things that will vary from month-to-month (groceries, transport, fun), into cash envelopes. You will make sure to create a specific purpose for every envelope. Then you will only spend what’s in each envelope.

For instance, if you have ₹5,000 for groceries and ₹2,000 for eating out, you will put that cash in two separate envelopes. When you have spent what is in the grocery envelope, you will not go grocery shopping until the next month! It will force discipline, and considering how cash is still the best way to pay for smaller purchases when you are in India, this is a great way to limit your spending.

Why It Works in India? Many Indians rely on cash for all their daily expenses, and creating an envelope for each of your major expenditures aligns with those habits. It also helps curb those impulse purchases for that extra chai or extra street food for fun!

Check out our guide on saving for emergencies.

Trick 3: Automate Your Savings to Build Wealth

One of the easiest and most effective budgeting tricks is to automate your savings. Set up an auto-debit, automatically moving funds from your salary account to a savings account (or Recurring Deposit), or a Systematic Investment Plan (SIP) in a mutual fund. For example: If your monthly salary is ₹40,000, have ₹8,000 (20%) automatically moved to a saving account, or an SIP in a mutual fund like HDFC Equity Fund.

Why Automate? To eliminate the chance to spend, before saving. In India, where fixed deposits and mutual funds are widely used, its a great way to build wealth without you even having to think about it. Imagine you have a SIP in a mutual fund of ₹5,000 monthly, growing at an annual rate of 12 percent, it could be worth over ₹10 lakh in 10 years!

Pro Tip: Use online banking apps from banks like SBI or ICICI to create automatic transfers each payday.

Trick 4: Shop Smart with Cashback and Discounts

Indians love discounts, and using discounts is a great budgeting tricks. Many platforms, such as Amazon India and Flipkart, savers get cash back, bank offers, and seasonal demos. Before you buy, see if you can shop around on different apps, such as Paytm Mall or Myntra, and don’t forget to check cashback apps like CashKaro for additional savings.

Example: If you’re going to buy a ₹20,000 smart phone, a bank discount of 10% and cashback of 5% will help you save ₹3000. Small savings add up over a period of time, like year.

Indian Hack: Buy during the sales around festivals like Amazon’s Great Indian Festival or Flipkart’s Big Billion Days for the highest discounts. Also, start using UPI apps such as Google Pay for cashback deals and use them on your daily transactions.

Learn more about maximizing savings in our article

Trick 5: Plan Your Meals to Cut Food Costs

Grocery expenses can take up a huge part of your budget, especially in cities in India, where ordering food, and food delivery apps such as Swiggy and Zomato, can be hard to resist. One of the best ways to budget for food is through meal planning. You can do this by planning out your meals for the week, buying groceries in bulk, and then cooking more often at home.

Here is an example budget. Let’s say your grocery budget for a family of four is ₹8,000 a month. You would spend about ₹1,500 on rice, a total of ₹1,000 on pulses, and about ₹2,500 on fruits and vegetables. You could buy these things in bulk – from a local market or from an app like BigBasket. Overall, dining out or ordering food can cost 30-40% more than cooking at home.

Pro tip: Create a weekly menu and follow it as closely as possible. For example, you could plan dal-rice on Monday, veggie stir-fry on Tuesday, etc. It also helps create a menu and also takes away some of waste and impulsive buying.

Trick 6: Track Every Paisa with a Budgeting App

Tracking expenses is a cornerstone of effective budgeting tricks. Use apps like Walnut or YNAB (You Need A Budget) to monitor where your money goes. These apps categorize your spending (e.g., groceries, transport, bills) and highlight areas to cut back.

Example: If you notice you’re spending ₹3,000 monthly on coffee shops, switch to brewing at home for ₹500 a month. That’s a ₹2,500 saving! In India, where small expenses like auto-rickshaw fares or chai add up, tracking every paisa is crucial.

Trick 7: Build an Emergency Fund for Peace of Mind

Unexpected expenses like medical emergencies or job loss can derail your budget. One of the most critical budgeting tricks is building an emergency fund. Aim to save 3-6 months’ worth of expenses (e.g., ₹1.5-3 lakh for a ₹50,000 monthly expense household).

How to Start: Save ₹2,000-5,000 monthly in a high-interest savings account or liquid mutual fund. For example, a liquid fund yielding 7% annually can grow your ₹5,000 monthly savings to ₹65,000 in a year.

Why It’s Crucial in India: With rising healthcare costs and economic uncertainties, an emergency fund is your financial safety net.

Common Budgeting Mistakes to Avoid

While these budgeting tricks are powerful, avoid these pitfalls:

- Not Tracking Small Expenses: That ₹50 daily chai adds up to ₹1,500 monthly!

- Ignoring Debt: Pay off high-interest loans (e.g., credit card debt at 36% interest) before investing.

- No Buffer for Inflation: With India’s inflation rate around 5-6%, factor in rising costs when budgeting.

How to Stay Motivated with Your Budget

When you’re working within a budget, it can feel a bit constricting at times, but it is about freedom, not restriction. Treat yourself when you meet your savings milestones – for example: a ₹500 night at the movies after saving ₹5,000. Share your journey with a friend, or join online communities, like Reddit India (do-follow), to keep your motivation levels high.

Conclusion

You don’t need a finance degree to get a grip on your finances—you just need the right budgeting tricks. The 50/30/20 rule, envelope system, automated savings, smart shopping, meal planning, tracking expenses, and saving for the future are all budgeting tricks you can use to take control of your money and accomplish your goals and dreams. Start small, keep moving forward, and watch your savings gain ground. Which budgeting trick are you going to try first? Let us know in the comments!

1 thought on “7 Fool Proof Budgeting Tricks Every Indian Should Know”