Budgeting mistakes can quietly undermine your financial goals, especially in India. Rising costs these days, like ₹150 for a quick snack or ₹10,000 for a flat on rent, will see to it that every rupee counts! It does not matter if you are a young professional, housewife, or householder; one thing is certain: steering clear of budgeting mistakes is crucial to building wealth!

In this article, we identify 7 shocking budgeting mistakes you need to be aware of that are quietly sabotaging your savings. Additionally, we will provide you practical tips based on rupees to help you correct them. These tips are catered to the Indian way of life so you will be in charge of your money and saving more!

Table of Contents

Why Budgeting Mistakes Hurt Your Finances in India

In India, with annual inflation averaging 5–6% (source: RBI), those Budgeting mistakes can very well cost you a thousand rupees over time. Just one slip-up, such as eating out too often, can destroy your desire to save. By correcting these budgeting mistakes, you can protect your money, begin building an emergency fund, and plan your saving goals and dreams like buying a home, sending a child to school, etc. Let’s take a look at the 7 budgeting mistakes you (probably) make, and how to fix them.

1. Not Tracking Your Expenses

Not knowing where your money goes is one of the biggest wrongs in budgeting. Before you realise it, you could easily have ₹2000 on coffee or ₹5000 on online shopping, purely because you are not tracking.

Why It Matters: Untracked expenses mean you can easily overspend and have little to save for yourself.

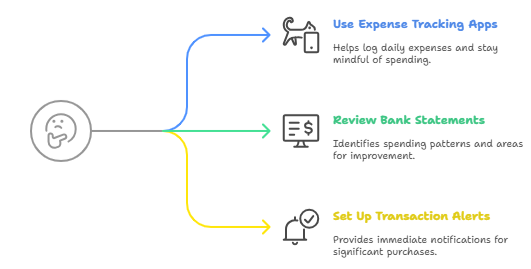

How To Improve It:

- Make use of apps like Moneycontrol to document your everyday expenses (even if it’s ₹500 on groceries) to see where you’d consumed money.

- Look at your bank statements weekly to work out where your money goes.

- Set up transaction alert limits only for purchases above ₹500 and become aware.

Practical Tip: Keep a little notepad or budgeting app, to put down each daily spend (e.g. ₹200 on transport).

Learn expense tracking in our budgeting guide for Indian households.

2. Ignoring Small Expenses

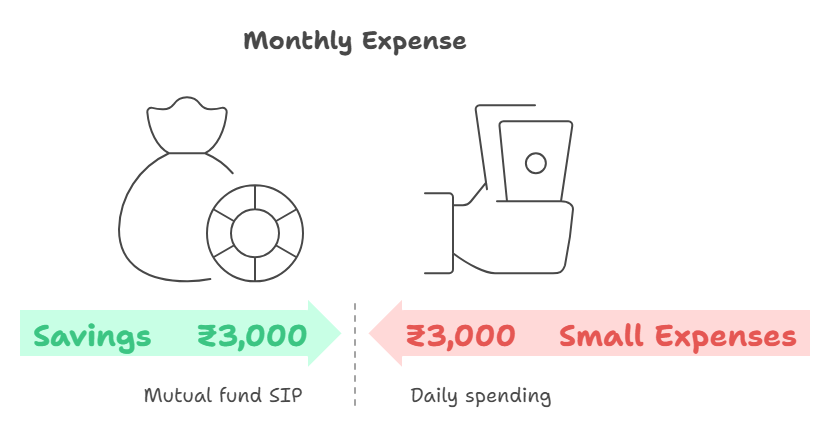

Small amounts – a ₹50 chai here, a ₹200 movie ticket there – don’t seem significant, but they can add up. It is very easy to forget about these small spends and it is one of the biggest budgeting mistakes you can make; it chips away your savings.

Why It Matters: Spending just ₹100 on small items every day adds up to ₹3,000 a month – or enough for a mutual fund SIP.

How to Fix It:

- Set yourself a weekly “small spend” limit (for example, ₹500).

- To heighten your awareness of small daily purchases, use cash.

- Buy snacks or essential items in bulk from wholesalers to save up to ₹1,000-2,000 every month.

Practical Tip: Skip one food delivery service a week that costs ₹300 – you’ll save ₹1,200 a month!

Read more on managing small expenses at BankBazaar.

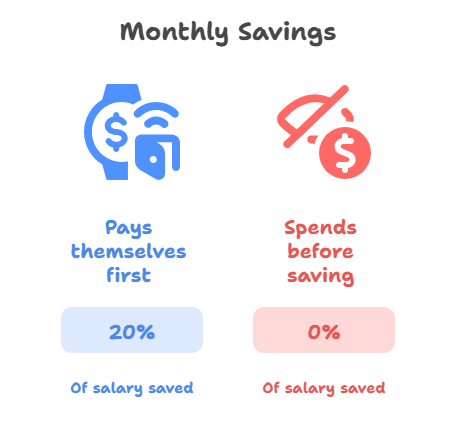

3. Spending Before Saving

A common budgeting error is to treat saving as an afterthought. Instead of seeing savings first, if you spend your ₹30,000 salary, then you often have nothing left to save.

Why It Matters: Making spending more important than saving keeps you from ever building wealth.

How to Fix It:

- Follow the “pay yourself first” rule: save 20% (₹6,000) first then spend the rest of your salary.

- Set up an auto-debit to a savings account e.g. SBI’s ₹1,000/month RD.

- Transfer ₹2,000 a month to a liquid fund through Groww.

Practical Tip: Automate your savings directly after your salary is credited, this then avoids temptation.

Also Read: Discover saving strategies in our emergency fund guide.

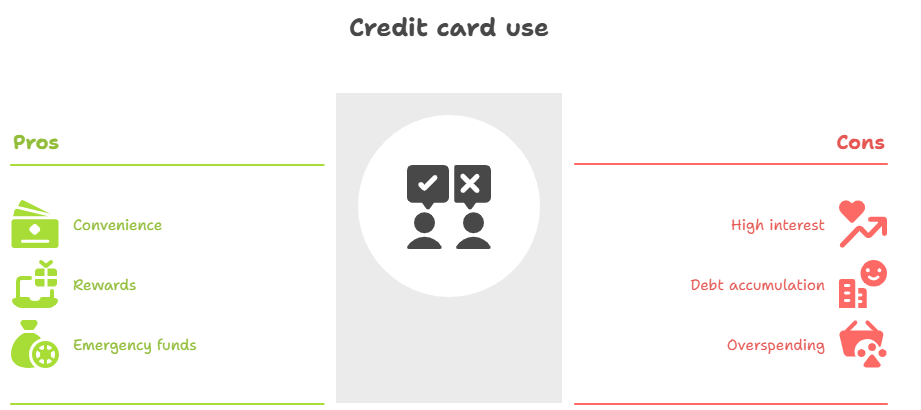

4. Over-Relying on Credit Cards.

Using credit cards for daily expenses is one of the budgeting mistakes that can lead to debt, with interest rates as high as 40% annually in India.

- Why It Hurts: Unpaid balances accrue interest, costing ₹1,000–₹5,000 extra monthly.

- How to Fix It:

- Use credit cards only for emergencies or big purchases with rewards.

- Pay the full balance monthly to avoid interest charges.

- Stick to debit cards for routine expenses like ₹4,000 on groceries.

- Practical Tip: Limit credit card use to one bill (e.g., ₹2,000) and pay it off immediately.

Learn credit card management at Paisabazaar.

5. Not Planning for Irregular Expenses

Failing to budget for irregular expenses, like ₹10,000 for car repairs or ₹5,000 for festival gifts, is a sneaky budgeting mistakes that disrupts your savings.

- Why It Hurts: Unexpected costs force you to dip into savings or take loans.

- How to Fix It:

- Create a sinking fund: Save ₹500–₹1,000/month for annual expenses like insurance.

- List upcoming costs (e.g., ₹3,000 for Diwali gifts) in your budget.

- Set aside ₹1,000/month for unexpected costs like medical checkups.

- Practical Tip: Use a separate savings account for irregular expenses to stay organized.

Check out: Plan for emergencies with our guide to saving ₹100 a day.

6. Sticking to an Unrealistic Budget

A budget that is too strict—like a budget with only ₹2000 for groceries instead of ₹5000—is a budgeting mistake that will always leave the budgeter frustrated and failing.

Why It Hurts: If what you want versus what you can afford are not aligned, unrealistic budgets will be challenging to adhere to, and you will give up.

How to Fix It:

- 50/30/20. 50% – needs (Like ₹15,000), 30% – want (Like ₹9,000), 20%-saving (Like ₹6,000).

- Make the budget averages for a month based to adjust what you spent.

- Leave ₹1,000 buffer for unexpected expenses, such as utility bills variation.

Practical tip: Try your budget for one-month and adjust it to fit your lifestyle. Explore budgeting tools at Zerodha Varsity.

7. Not Reviewing Your Budget Regularly

A static budget that doesn’t adapt to changes, like a ₹5,000 salary increase or ₹2,000 rent hike, is another budgeting mistakes that limits your savings potential.

- Why It Hurts: Outdated budgets miss new expenses or savings opportunities.

- How to Fix It:

- Review your budget every 3 months.

- Redirect extra income (e.g., ₹2,000 bonus) to savings or investments.

- Adjust for rising costs like groceries (up 7% yearly).

- Practical Tip: Set a calendar reminder to update your budget quarterly.

Bonus Tips to Avoid Budgeting Mistakes

- Leverage Technology: Use apps like Walnut or YNAB to track spending and avoid budgeting mistakes.

- Set Clear Goals: Aim for targets like saving ₹50,000 for an emergency fund.

- Stay Accountable: Share your budget with a trusted friend or family member.

- Keep Learning: Follow financial blogs like RupeeNest for ongoing tips.

Take Control of Your Finances Today

Budgeting mistakes can quietly cost you money, but they can also be corrected. Know your expenses, save first, avoid credit card traps, and plan for non-monthly costs. Most people make the same 7 budgeting mistakes in India. With practical tips based on real life and in rupees, you can overcome them. Start now! Download a budgeting app, review your expenses, or set up a recurring auto-debit for savings. Your financial future is in your hands!

Call to Action: Share your budgeting mistakes and fixes in the comments.

3 thoughts on “Shocking Truth: 7 Budgeting Mistakes That Are Silently Killing Your Savings”